Realising West Africa’s true potential

NOG to foster multistakeholder engagement

LNG for energy security

Emerging nations closing major deals

South Africa’s gas resources can address the energy crisis, believes Petroleum Agency SA, Pg 20

WWW.OILREVIEWAFRICA.COM VOLUME 18 | ISSUE 3 2023

A lot is happening in West Africa’s oil and gas sector.

(Image Credit: Adobe Stock)

EDITOR’S NOTE

IN THIS ISSUE, we watch as West Africa’s up-and-coming nations such as Ivory Coast, Sierra Leone and the Gambia take baby steps to reach the hydrocarbons hold of established ones like Angola or Senegal. This best reflects in the President of Ivory Coast, Alassane Ouattara’s ambitions of seeing the country as a ‘major’ oil producer by 2023.

While at it, Nigeria stole all limelight with the breaking news of the Dangote Refinery commissioning. Creating many firsts, the 650,000 bopd refinery boasts to be Africa’s largest and can be the game changer for downstream petroleum products.

As this development came in like a breath of fresh air amid the rapidly falling production count of Nigeria, a tech company named James Fisher’s initiatives to assess vulnerabilities of the oil asset adds to the silver lining. On that backdrop, the NOG Conference and Exhibition this year is sure to witness a lot of action.

Dive right in for all these and many more insights into Africa’s oil and gas industry.

Madhurima Sengupta Editor

CONTENTS

Editor: Madhurima Sengupta

madhurima.sengupta@alaincharles.com

Editorial and Design team: Prashanth AP, Fyna Ashwath, Sania Aziz, Miriam Brtkova, Praveen CP, Robert Daniels, Shivani Dhruv, Matthew Hayhoe, Leah Kelly, Rahul Puthenveedu, Madhuri Ramesh, Louise Waters and Minhaj Zia

Publisher: Nick Fordham

Head of Sales: Vinay Nair

E-mail: vinay.nair@alaincharles.com

International Representatives

IndiaTanmay Mishra

NigeriaBola Olowo

South AfricaSally Young

Head Office:

Alain Charles Publishing Ltd

University House, 11-13 Lower Grosvenor Place, London SW1W 0EX, United Kingdom

Tel: +44 (0) 20 7834 7676 Fax: +44 (0) 20 7973 0076

Middle East Regional Office:

Alain Charles Middle East FZ-LLC Office L2-112, Loft Office 2, Entrance B

P.O. Box 502207, Dubai Media City, UAE

Tel: +971 4 448 9260 Fax: +971 4 448 9261

Production: Rinta Denil, Ranjith Ekambaram, Eugenia Nelly Mendes and Infant Prakash

E-mail: production@alaincharles.com

Subscriptions: circulation@alaincharles.com

Chairman: Derek Fordham

Printed by: Buxton Press

Printed in: June

© Oil Review Africa ISSN: 0-9552126-1-8

22

NOG Energy Week

NOG will take place from 9-13 July at the International Conference Centre, Abuja

Offshore Construction

From production facilities to storage tanks, lot goes into the smooth running of O&G infrastructure

Pipelines

Africa’s major projects call for secure pipeline infrastructure

Serving the world of business

NEWS 4 Calendar of events Diary dates of executives 6 News Afentra’s INA acquisition, Petrofac in

President on O&G development,

infrastructure COVER STORY 10 Senegal and Angola Vast O&G resources make up the West African countries SPECIAL FEATURES 12 Ivory Coast, Sierra Leone and the Gambia The countries are closing in on big discoveries and drilling projects. 14 LNG and FLNG

turns to gas as source of energy security and decarbonisation

Algeria, Uganda’s

Angola’s O&G

Africa

TECHNOLOGY AND OPERATIONS

24

29

INTERVIEW 16 Effectively monitoring complicated infrastructure James Fisher on digital twin technology

ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 3

Executives Calendar 2023

JUNE

14-16 South Sudan Oil & Power

Juba

https://www.southsudanoilpower.com/

JULY

2-5 Nigeria Oil & Gas Conference & Exhibition

Abuja

www.cwcnog.com

31-2 Aug ECOWAS Mining & Petroleum Forum & Exhibition

Abidjan

www.ametrade.com/ecomof

SEPTEMBER

5-8 Gastech

Milan

https://www.gastechevent.com/

5-8 SPE Offshore Europe

Aberdeen

https://www.offshore-europe.co.uk/

17-21 World Petroleum Congress

Calgary

https://www.24wpc.com/

19-21 Nigeria Energy

Lagos

https://www.nigeria-energy.com/

27-28 Mozambique Gas & Power

Maputo

https://www.mozambiqueenergysummit.com/

OCTOBER

2-5 ADIPEC

Abu Dhabi

https://www.adipec.com/

Readers should verify dates and location with sponsoring organisations, as this information is sometimes subject to change.

ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM EVENTS CALENDAR 4

Opportunities aplenty for Angolaʼs oil and gas infrastructure

ANGOLA HAS EMERGED as an investment hotspot in recent years with a host of major and independent oil and gas firms and service companies either expanding their presence in the region or emerging into the scene.

While the country has longseen foreign capital flow into the market, heightened investment in recent months has largely been due to advancements across the sector. Angola’s attractiveness as an investment haven is expected to increase even further moving forward, and the country’s highly coveted premier energy event –the Angola Oil & Gas (AOG) conference which will return for its fourth edition in 2023 boasting the theme ‘Investing in Angola’s Oil and Gas Infrastructure is Investing in the

Future’ – will showcase the range of infrastructure and associated energy investment opportunities across the Angolan market.

The government’s agenda to maximise the rollout of upstream infrastructure in a bid to boost oil and gas reserves, increase production capacity and take advantage of the rise in global energy prices is boosting the flow

Tower Resources gives update on Thali PSC

AIMLISTED OIL AND gas company, Tower Resources plc, has provided an update on its activities in regard to its Thali Production Sharing Contract (PSC) in the Rio Del Rey sedimentary basin offshore Cameroon.

of investments into the industry, at the same time that the country is positioning itself as a regional energy hub for downstream activity as well. Opportunities have arisen for growth across all sectors of the industry and Angola is steadfast in its approach to becoming the destination of choice for investment prospects.

Afentra completes INA acquisition offshore Angola

AFENTRA HAS ANNOUNCED the completion of the acquisition from INA-Industrija (INA) of a 4% interest respectively in Blocks 3/05 and 3/05A offshore Angola. The acquisition marks Afentra’s entry into Angola where it is well

positioned to build a material production business and contribute to a responsible energy transition for the country.

Afentra CEO, Paul McDade, said, “We are very pleased to complete the INA Acquisition

and we would like to thank all involved, especially our shareholders, for their continued patience and support.”

“We now look forward to working with the partnership to enhance production and reserves to a level that reflects the potential of this very material asset.”

The Block 3/05 JV partners and ANPG, the Angolan Oil & Gas regulator, have now agreed the terms of the Block’s license extension, extending the production sharing agreement from 1 July 2025 to 31 December 2040.

Afentra expects to sell its first cargo of crude oil in Q3 2023. The current gross production numbers for Block 3/05 averaged at 19,000 bbl/d.

The company has applied for a one-year extension of the initial exploration period of the PSC, following positive discussions with the Minister of Mines, Industry and Technological Development (MINMIDT) and the Prime Minister of the Republic of Cameroon.

Discussions are also continuing with the rig owners and operators with the aim to secure rig availability in Q3/Q4 of this year for drilling prospects at NJOM-3.

Other ongoing developments on the Thali PSC include the deployment of Paradise software to conduct detailed attribute analysis of the reprocessed 3D seismic data to successfully identify the oil and gas elements of the reservoirs in the Njonji-1 and Njonji-2 fault blocks. This has resulted in a clearer picture of the pay zones in both of the fault blocks.

Jeremy Asher, Tower Resources chairman and CEO, said, “We are very pleased with the progress that we are making on the Thali PSC and the NJOM3 well, and we believe that we are close to having a final schedule for this well, which will be transformational for the company.”

“We are as excited as ever about the Thali PSC, and very grateful to MINMIDT and the Republic of Cameroon for their continued support.”

ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM NEWS 6

The acquisition marks Afentra’s entry into the Angolan market.

Image Credit: Adobe Stock

Image Credit: Adobe Stock

Heightened investments are largely in part to the advancements made in the Angolan oil and gas sector.

Uganda taps into Algerian expertise

UGANDA NATIONAL OIL Company (UNOC) has signed a memorandum of understanding (MoU) with Algeria’s Sonatrach regarding oil and gas resources found in both countries.

According to the United States Department of Commerce, Algeria has the tenth-largest proven natural gas reserves globally, is the world’s fourth-largest gas exporter, and has the world’s third-largest untapped shale gas resources. In regards to oil, it is ranked sixteenth in proven oil reserves.

Uganda, on the other hand, has 6.5bn barrels of crude oil in place with 1.4-1.7bn barrels recoverable.

In order to make the most of its hydrocarbon opportunity, UNOC has looked to tap into the North African country’s expertise and has signed an MoU with Sonatrach.

The agreement was signed by Michael Mugerwa, general manager of Uganda Refinery Holding Company, and Toufik Hakkar, chairman of Sonatrach, in the presence of Ugandan President Yoweri Museveni and Algerian President Abdelmadjid Tebboune.

The MoU covers several areas of cooperation related to exploration and production, marketing, processing and downstream activities. It also includes aspects related to oil and gas services as well as provisions relating to the development of training and the exchange of expertise.

President Museveni later stated on Twitter that he is looking at Algeria for investing in a refinery – a strategic project that is a priority of UNOC.

Petrofac-led joint venture to deliver significant petrochemical project in Algeria

PETROFAC, LEADING A joint venture with petrochemical industry specialist, China Huanqiu Contracting and Engineering Corporation (HQC), has received notification of a conditional award by STEP Polymers SPA (a 100% Sonatrach subsidiary) to execute a significant petrochemical project located at the Arzew Industrial Zone, west of Algiers.

The total contract value is approximately US$1.5bn, with Petrofac’s share valued at more than US$1bn. Covering the design and build of two major integrated processing units, the contract includes the delivery of a new propane dehydrogenation unit and polypropylene production unit, as well as associated utilities and infrastructure for the site. It is expected to produce 550,000 tons of polypropylene per year.

Tareq Kawash, Petrofac’s group chief executive, said, “We are proud to be supporting our customer to deliver this strategic project. Algeria is a core market for Petrofac and we are committed to supporting the long-term delivery of critical infrastructure as the country plays an increasingly important role as a major energy producer and moves into major petrochemical projects.”

Elie Lahoud, chief operating officer for Petrofac’s

engineering and construction division, said, “The award of this major project builds on Petrofac’s 25year track record of successfully supporting Algeria’s energy industry. As our client responds to the world’s increasing demand for petrochemical products, we are looking forward to developing our breadth of experience in-country, through the safe and timely delivery of this project.”

This contract award forms part of the US$1.5bn opportunities described by Petrofac as being at preferred bidder stage in its December trading update.

Progress on Tendrara Production Concession Phase

2

SOUND ENERGY HAS provided a financing update in relation to the Tendrara Production Concession in Morocco.

In June 2022, the company announced that it had entered into an arrangement and mandate letter (Mandate) with Attijariwafa bank (the Arranger), a Moroccan

multinational bank, under which the company mandated the bank in relation to the arrangement of project debt financing for the Phase 2 development of the Tendrara Production Concession. Under this agreement, the Arranger was mandated and provided with exclusivity by the

company until 1 June 2023 to arrange a long-term project senior debt facility with a term of no more than 12 years up to 2.25bn dirhams (approximately US$223mn) for the partial financing of the Phase 2 development cost – currently estimated at approximately US$330mn.

Sound Energy has been advised by the Arranger that it has now concluded its due diligence in respect of the financing

Graham Lyon, executive chairman of Sound Energy, remarked, “The Phase 2 senior debt process has completed its due diligence phase with recommendations to Attijariwafa's credit committee prepared by the Arranger. We look forward to providing further updates."

NEWS ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 7

The plant is expected to produce 550,000 tons of polypropylene per year.

Image Credit: Adobe Stock

Image Credit: Adobe Stock

Phase 2 includes the implementation of a 20’’, 120 km gas export pipeline alongside other developments.

President Yoweri Museveni emphasises O&G development for Uganda's advancement

AFRICA MUST BE helped to secure the economic benefits from oil and gas development which can help raise millions of people out of poverty, the 10th annual East African Petroleum Conference and Exhibition was told.

Delegates at the event, which was staged in Uganda’s capital city Kampala, were addressed on how the continent is one of the most carbon-positive continents on the planet and should be allowed to secure its own path to much needed economic development.

The event is being staged at a time when Uganda is on course to become an oil and gas producing country for the first time with it being intended that the first oil will be pumped by 2025. The 1,445-km East Africa

Crude Oil Pipeline (EACOP) is being built to transport the natural resource from Uganda through Tanzania for export.

The three-day conference and exhibition is being held under the theme ‘East Africa as a hub for investment in exploration and exploitation of petroleum resources for sustainable energy

Africa Oil decides to withdraw from Kenya project

and socioeconomic development,’ and aims to attract petroleum stakeholders in the region to discuss investment opportunities in the oil and gas sector.

Other discussions to dominate the event included the subject of Africa and climate change and the continent’s need to find adaptation measures.

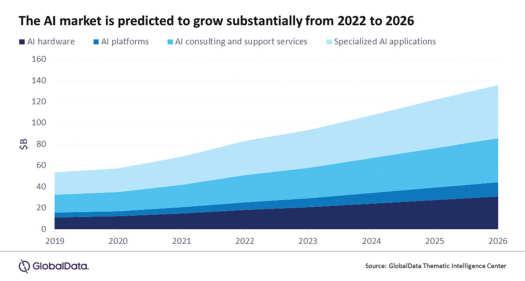

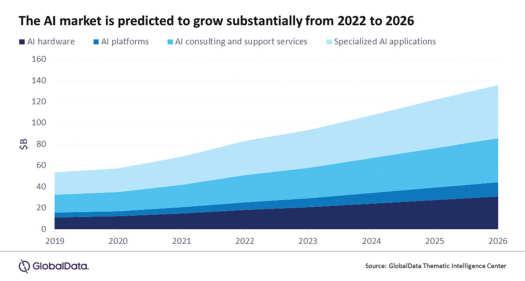

Machine learning has potential to transform oil and gas industry, says GlobalData

MACHINE LEARNING HAS the potential to improve efficiency, increase production, and reduce costs in the oil and gas industry, says GlobalData, a leading data and analytics company.

GlobalData’s thematic report, ‘Machine Learning in Oil and

Gas,’ provides an overview of the machine learning technology and its growing importance in oil and gas operations. It also highlights the efforts of major oil and gas companies, such as BP, ExxonMobil, Saudi Aramco, Shell, and TotalEnergies, in the development and

implementation of machine learning tools to address business problems. The Organisation for Economic Co-operation and Development (OECD) estimates that AI could add as much as US$16 trillion to the world’s GDP by 2030, equivalent to more than 10% of the gross world product.

“Oil and gas companies have deployed machine learning algorithms to track performance across diverse assets. The technology is also aiding companies in inventory management and supply chain optimisation. Machine learning has vast potential in the energy sector and will continue to find new applications to automate and optimise,” concludes Ravindra Puranik, Oil and Gas analyst at GlobalData.

AFRICA OIL CORP has submitted withdrawal notices to its joint venture partners on Blocks 10BB, 13T and 10BA in Kenya to unconditionally and irrevocably withdraw from the entirety of the joint operating agreements ('JOAs') and Production Sharing Contracts ('PSCs') for these concessions. The company has concurrently submitted notices to the Ministry of Energy and Petroleum, requesting the government's consent to transfer all of its rights and obligations under the PSCs to its remaining joint venture partner.

The carrying value of the Kenya intangible exploration assets was written down to US$58.6mn at 31 December 2022, with the company intending to further impair this value to zero.

“We have taken the decision to exit our Kenya concessions as our strategy has shifted to focus on production and high potential exploration opportunities, including our Orange Basin portfolio where we are now appraising the exciting Venus discovery, offshore Namibia,” commented Africa Oil president and CEO, Keith Hill.

Africa Oil is proud to have played a central role in discovering the oil fields in Kenya's South Lokichar Basin, and continues to believe that these discoveries will form the basis of a significant oil producing province in the coming years, with strategic value for the country.

ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM NEWS 8

The AI market is predicted to grow substantially from 2022 to 2026.

Image

Credit: Adobe Stock

Image Credit: GlobalData Thematic Intelligence Centre

Steps are being taken to ensure oil and gas sector would help deliver economic development for all Ugandans.

Tullow Oil releases Kenya exploration update

TULLOW OIL HAS announced that Tullow Kenya, as operator of its licences in Kenya, has been informed by its two minority partners of their intention to issue notices of withdrawal from Blocks 10BB, 13T and 10BA in the South Lokichar Basin for differing internal strategic reasons. As a result, Tullow's working interest in these blocks will increase from 50% to 100%.

The board considers that owning 100% of the Project creates more optionality, gives Tullow more flexibility in the ongoing process to secure strategic partners, creates a simpler Joint Venture Partnership and streamlines project delivery. This is a low-cost development project that has the potential to unlock material value for Kenya.

The prospective strategic partners have been informed. They remain engaged and detailed farm-out discussions continue with a number of companies. Whilst the process has taken longer than expected, Tullow remains focused on securing a strategic partnership this year.

Project progress continues and the updated Field Development Plan (FDP) was submitted to the Kenyan regulator, Energy and Petroleum Regulatory Authority (EPRA), in March 2023 and is now under review by EPRA. Tullow will continue to work collaboratively with Government of Kenya and EPRA to get the FDP approved.

Tullow looks forward to continuing its work with the Government of Kenya and its host communities to make the region a significant energy producing province.

GlobalData: UAE economic growth in 2023 threatened by oil decline and external demand challenges

GLOBALDATA’S LATEST REPORT, ‘Macroeconomic Outlook Report: UAE’, has revealed that with around 30% of the country's GDP and 13% of total exports, oil and gas industry plays a crucial role in the UAE's economy. 2022 witnessed a significant economic upturn, with a growth rate of 7.6%, the highest since 2007, primarily fueled by surging oil and gas prices. However, the decline in O&G prices since the beginning of 2023, expected to persist throughout the year, directly impacts the UAE's economic growth prospects for the current year.

Indrajit Banerjee, economic research analyst at GlobalData, commented, “To make the

economy less vulnerable to external shocks, it remains crucial for the government to persist in its endeavour to diversify the economy. Abu Dhabi’s plan to invest US$2.7bn to double the size of the manufacturing sector by 2031, and the adoption UAE Circular Economy Policy 2031 that focuses on manufacturing, food, green infrastructure, and sustainable

transport, reflects the government’s urge to transform to a more diversified economic base.”

The UAE is categorised as a very low-risk nation, with risk score lower in the parameters of political environment, macroeconomic, social, and environmental risk when compared to the average of Middle East and North African nations.

Gabon's gas master plan: Less flaring, more energy security

IN THE CENTRAL African region, Gabon stands out for its political stability, investorfriendly policies and enduring status as one of Africa’s most prolific oil producers.

The country’s 2023-2027 economic plans are on track to usher in a new era of growth on the back of the diversification and industrialisation of the Gabonese energy sector. As Gabon gears up

for its 2023 election, the ruling Parti Démocratique Gabonais (PDG) is expected to retain power and the government’s 2023-2027 economic plans look set to proceed. These plans centre on strengthening and diversifying the national economy by breathing new life into Gabon’s oil and gas industry, increasing domestic processing of raw materials, rendering industrial services more competitive, and promoting the sustainable development of natural resources.

Buoyed by political stability, an influx of foreign direct investment and growing support from international partners, Gabon is expected to become an emerging economy by 2025, with projected GDP growth of roughly 3% by the close of 2023.

NEWS ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 9

Oil and gas industry plays a crucial role in the UAE's economy.

The country’s 2023-2027 economic plans are built on the diversification and industrialisation of the Gabonese energy sector.

Image Credit: Adobe Stock

Image Credit: Adobe Stock

LEVERA GING VAST OIL AND GAS RESOURCES

While Angola is the second largest oil producer of sub-Saharan Africa, Senegal is looking forward to its first hydrocarbon production this year.

WHILE GEOPOLITICAL TENSIONS

rising from the eastern European conflict have shaken the global oil market, it has opened doors for Africa, consolidating the nation from within. Last year, Senegal and Angola signed multiple bilateral agreements – oil and gas being one of the major areas – to mark the beginning of a strong, mutual cooperation. The agreements were signed by Macky Sall, President of Senegal, and João Lourenço, President of Angola, when the former went on a

diplomatic tour in Luanda. Though treaties were signed in other fields as well, the main objective of the two heads of states’ meeting was to extend cooperation towards economic development, especially with

regard to oil and gas reserves.

While economically, Senegal stands in the fourth position among west African countries and is looking forward to its first hydrocarbon production this year, including 2.5 mn tons of liquefied natural gas (LNG), Angola enjoys a long-standing reputation as the second largest oil producer of sub-Saharan Africa at 1.3 bn bopd and 17.9 mn cu/ft of natural gas production. With Senegal’s rising prominence due to the abundant reserves discovered in the MSGBC gas rush, both countries have huge untapped potential

ahead of them in terms of bilateral exchanges of policy design, technical insights and investment strategy.

Angola and Senegal are members of important regional bodies, not to mention, the African Union. This is most likely the beginning for the two countries to explore further trade opportunities. Senegal can now benefit from Angola’s more than 60 years’ worth of experience in the sector.

Angola

Angola is one of the top producers that will contribute to

Senegal can make most of Angola’s 60-plus years of experience in the oil and gas sector.”

ANGOLA AND SENEGAL ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 10

Angola plans to construct more refineries following the success of the Luanda Refinery.

Image Credit: Adobe Stock

over 80% of Africa’s 2023 liquids output. The country's production has soared, reaching 34.29 mn barrels in January – an increase of more than 580,000 barrels over the prior month. Its capacity has more than tripled since it completed the rehabilitation and expansion of its 65,000 bpd Luanda Refinery. That, coupled with rising oil prices, has catapulted the number of oil and gas investments in Angola, according to a recent report by Deutsche Bank. Also, the Organisation of Petroleum Exporting Countries' (OPEC) monthly oil market analysis put Angola at the top of African crude oil producers, with 1.06 mn bpd production in April.

Representing sub-Saharan Africa’s largest oil producer and boasting remarkable upstream developments, Angola’s downstream market is currently in the midst of a major transformation, owing primarily to the prolific development of the country’s refining capacity. Plans to increase its refining capacity to 425,000 bpd have been expedited by the completion of an additional gasoline production unit at the existing Luanda Refinery and will include the construction of several new refineries in Cabinda, Lobito, and Soyo.

Senegal

With projects like the Greater Tortue Ahmeyim, Sangomar Field Development and Yakaar-Teranga Development

underway, things seem to be moving well according to plans for Senegal as the country's Minister of Petroleum and Energies, Sophie Gladima, said during last year's African Energy Week, "We will start in 2023 with gas production."

Senegal’s Sangomar Field Development, reportedly 82% complete as of April, is expected to yield its first oil this year. The US$4.6bn project, led by Woodside Energy in partnership with Senegal’s national oil firm Petrosen, can produce approximately 231 mn barrels of oil in its first phase of development, with total recoverable oil resources estimated at around 500 mn barrels over its lifetime. According to Woodside's first quarter report, 10 of 23 wells have been drilled since mid-2021, when the project began. With the fruition of this project, Senegal will see its first offshore oil production.

Straddling the maritime border between Senegal and Mauritania, the US$4.8bn GTA LNG project that is due to come online this year, has kicked off with the arrival of the floating, production, storage and offloading (FPSO) vessel from Qidong, China. It will make SenegalMauritania one of the major markets to drive Africa's LNG export infrastructure, which is expected to increase from the existing 80 mn tons per annum (mtpa) to about 110 mtpa by 2030, increasing even further to 175 mtpa by 2040.

Another Senegalese megaproject, the Yakaar-Teranga Development, which is set to come online in 2024, will be developed in two phases. The generated gas will then be supplied to state utility Senelec’s power plants, from where it will be distributed regionally.

ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM

Senegal is actively pursuing gas production.”

The GTA LNG project can make Senegal-Mauritania a major driver of Africa's LNG export infrastructure.

Image Credit: Adobe Stock

UNLOCKING UNTAPPED POTENTIAL

AS WEST AFRICAN countries such as Nigeria, Angola and Ghana usually attract major exploration and production deals, the upand-coming nations like Ivory Coast, Sierra Leone and the Gambia are also closing in on big discoveries and drilling projects.

The Gambia

The Nigerian National Petroleum Corporation (NNPC) has signed a memorandum of understanding (MoU) with the Gambian National Petroleum Corporation (GNPC) to explore and develop crude oil in Gambia. Under the agreement, the

companies will explore and evaluate potential oil resources in the Gambia, including geological and geophysical studies, seismic data acquisition and analysis.

The Gambia’s Investment and Export Promotion Agency Act of

2010, which grants incentives and rewards to energy investors, has not only expanded the country’s upstream activities, but also transformed the country into an attractive investment destination across all sectors.

After the single asset licensing round for the A1 Block, the Gambia is approaching its second licensing round, with bidding for five offshore blocks and two onshore blocks expected to see interest from international firms following the announcement by Australia-based FAR of a potential 1.5 bn barrels of oil unearthed in Gambian blocks A2 and A5 in 2022. To top the six

blocks already active, the Gambia is expecting a 5.1% GDP growth, and looking increasingly attractive as prospects.

License for the A4 block was awarded to PetroNor, as the company signed a petroleum, exploration, development and production licence agreement (PEPLA). It also entered a joint operating agreement (JOA) with the GNPC, under which it retains a 10% stake in the licence.

The terms of the PEPLA permits PetroNor an initial three year exploration period. Split into two phases, the first 18 months of this period involves a minimum work programme worth

NNPC and GNPC will explore and evaluate potential oil resources in the Gambia.”

Ivory Coast, Sierra Leone and the Gambia are closing in on big discoveries and drilling projects.

WEST AFRICA ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 12

Sierra Leone has hydrocarbon-rich, ultra-deep basins on offer.

Image Credit: Adobe Stock

US$1.5mn, with a US$1mn signature bonus.

Sierra Leone

The West African country is home to a working petroleum system that was supported by small-scale oil and gas discoveries, including the VenusB1, Mercury-1 and Jupiter-1 wells by Anadarko and the Savannah1X well by Lukoil. Oil and gas exploration in the country began nearly four decades ago with the drilling of two wildcat exploration wells, but was put on pause around 2015-16.

Last year, following highly positive results from a desktop study on the petroleum potential of the deepwater offshore blocks of Sierra Leone by an independent oil and gas explorer Wildcat Petroleum, the fifth licensing round was launched by the Petroleum Directorate.

The licensing round is slated to close at the end of September.

The PDSL has 56 graticules and 63,000 sq km in area on offer. According to Foday BL Mansaray, director general of PDSL, the Directorate also has hydrocarbon-rich, ultra-deep basins on offer through direct negotiations. It is seeking technically sound companies to partner with – those that can drill and have the capability to progress the Directorate’s exploration agenda. While giving an interview to the African Energy Chamber, he had assured that the entire basin is covered with 3D and 2D data, hence there

is a strong foundation for companies to advance and fasttrack exploration.

Speaking of the latest licensing round, he has said, “We have reduced the red tape for companies to come in with very simple and straightforward terms. We have only three nonnegotiable terms: a corporate income tax of 25%; a 10% royalty for oil and 5% royalty for gas; and a petroleum resources tax. The barriers to entry are very low. The period from application to ratification is 85 days, hence we have heavily improved our application period. We are also positioned within the Office of the Presidency and are very quick and nimble at making decisions.”

On the question of attracting new investment, Mansaray said,

“We had very fruitful meetings and conversations with companies in Qatar around natural gas, and we will be chatting with two Italian IOCs.”

Ivory Coast

The West African nation's modest output of 30,000 bpd has not stopped Alassane Ouattara, President of Ivory Coast, from nurturing ambitious plans of becoming a ‘major’ oil producer by this year. The motivation was fuelled by two consecutive discoveries of deposits by oil giant Eni and the state-owned national oil and gas company Petroci. The fresh discovery raises the potential of reserves by 25%. Known as the Baleine project, it is expected to yield over 2 bn barrels of crude oil and 2,400 to 3,300 bn cu/ft of natural gas in two phases.

Middle East fabrication yard

Drydocks World has upgraded a floating production, storage and offloading vessel destined for the Baleine project offshore Ivory Coast. Due this June, phase one involves three subsea wells tied back to Saipem’s veteran Firenze FPSO, which has been upgraded in Dubai. The FPSO can hold up to 15,000 bopd and around 25 mn cu/ft per day of gas.

Eni has made key contracting decisions on phase two as well, which is due to start December 2024.

Earlier, international companies such as French giant Total and Britain's Tullow Oil have announced significant offshore findings as well.

Also, a new combined cycle power plant is coming to Jaqueville.

Many firms in Ivory Coast are looking to leverage local resources to meet as much as 70% of the country’s oil and gas needs. While expanding their refinery capacity, they are also boosting their energy efficiency while reducing the sulphur and benzine capacity in petroleum products.

Slow but steady, the Gambia, Sierra Leone and Ivory Coast are catching up with the major oil and gas nations of Africa.

WEST AFRICA ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 13

President Alassane Ouattara wants to see Ivory Coast as a ‘major’ oil producer by this year.”

Ivory Coast, Sierra Leone and the Gambia are closing in on big discoveries and drilling projects.

Eni and Petroci made two consecutive discoveries of deposits in Baleine, Ivory Coast.

Image Credit: Adobe Stock

Image Credit: Adobe Stock

FINDING THE BALANCE FOR GREEN AND RELIABLE ENERGY

Africa looks to LNG and FLNG as a source of energy security and decarbonisation, reports Minhaj Zia.

IN RECENT YEARS, Africa has witnessed significant developments in the field of liquefied natural gas (LNG) and floating LNG (FLNG). The continent is home to vast offshore natural gas reserves, particularly in countries like Mozambique, Nigeria, Tanzania, Equatorial Guinea, and Senegal. These countries have been actively involved in the exploration, production, and export of LNG, with several large-scale projects underway. The advancements in LNG and FLNG infrastructure across Africa reflect the continent's increasing focus on harnessing its

natural gas resources to drive economic growth, attract foreign investment, and establish itself as a key player in the global LNG market.

EnerMech, a provider of integrated solutions, has

expanded its presence in the LNG market through securing four contracts with Angola LNG Limited (ALNG). This achievement has prompted the company to undertake a recruitment drive, focusing on hiring a substantial number of Angolan nationals to support these projects.

The primary contract involves a comprehensive three-year general maintenance agreement, aimed at ensuring the continued safety and efficiency of the plant. The team, consisting of 87 specialists, predominantly Angolan employees, is actively engaged in daily mechanical,

electrical, instrumentation, and plant operation support. The contract covers routine maintenance, engineering tasks, training programmes, and additional services, all contributing to the plant's technical integrity, safety, and environmental performance.

Additionally, EnerMech was awarded three specialist contracts for catalyst handling, highpressure water-blasting, and inspection services to facilitate ALNG's upcoming shutdown campaign in Soyo, Angola in 2022. In support of the campaign, the company deployed 163 personnel who successfully

In recent years, Africa has witnessed significant developments in the field of LNG and FLNG.”

LNG AND FLNG ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 14

EnerMech ALNG project team.

Image Credit: EnerMech

conducted inspection, maintenance, cleaning, and leak testing activities for on-site exchangers, as well as specialised tower and vessel internal inspections. The shutdown was executed without incidents, adhering to ALNG's safety standards and meeting their expectations in terms of timing and efficiency.

Christian Brown, CEO at EnerMech, said, “We are continuing to challenge the traditional contracting models, specifically around reducing contractors’ footprint, and this approach is proving successful as we accelerate our growth, utilising our strong reputation, global workforce, and extensive service offering. Over recent months, we have increased our offering in the LNG sector, and we expect this to increase further as existing maintenance contracts are renewed.”

Elsewhere, Congo has undergone a momentous development in the energy sector when His Excellency Denis Sassou Nguesso, President of the Republic of the Congo, joined forces with Claudio Descalzi, CEO of energy major Eni, in April. The event marked the commencement of the Congo LNG project, representing the nation's maiden foray into gas liquefaction and serving as a pivotal diversification strategy for Eni.

Anticipated to achieve an annual production capacity of 3 mn tonnes (equivalent to approximately 4.5 bn cu/m per year) by 2025, this initiative carries immense potential for the Republic of the Congo's energy sector. The project, featuring an accelerated development timeline and a zero-flaring approach, encompasses the installation of two FLNG plants, which will process gas from the already operational Nenè and Litchendjili fields, as well as future fields. The FLNG vessels, with capacities of 0.6 million tons per annum (mtpa) and 2.4 mtpa respectively,

are set to commence production in 2023 and 2025.

Recognising the project's significance in advancing energy security across Africa by leveraging natural gas resources, the African Energy Chamber, acting as the voice of the African energy sector, stands in support of this venture. Congo LNG will play a pivotal role in meeting the energy demands of the Republic of the Congo, while simultaneously bolstering economic growth and offering lucrative export opportunities.

The establishment of Congo LNG underscores the nation's resolve to unlock the potential of its natural resources and enhance its standing in the global energy market. By harnessing gas reserves and embracing LNG production, the Republic of the Congo strives to become a prominent player in the energy sector, fostering economic growth, job creation, and technological advancements.

Leveraging the abundant gas resources of the Marine XII block, Congo LNG will ensure a reliable source of power generation within the country.

Moreover, the project will contribute to Africa's energy security by supplying LNG to the regional energy market, catalysing industrialisation and socioeconomic progress across the continent. Beyond domestic benefits and value addition from gas, the project is poised to generate substantial revenue by supplying LNG to international markets, with a particular focus on Europe.

Moreover, Africa's role in the global gas market and its potential to replace Russia as Europe's gas supplier is gaining attention. At the December 2022 US-Africa Leaders Summit,

President Joe Biden pledged significant financing and investment, acknowledging Africa's growing influence in global affairs.

African countries recognise the importance of renewable energy but argue for the development of fossil energy resources to meet economic needs and provide modern energy access. The war in Ukraine and high energy prices have prompted international energy companies to consider oil and gas projects in Africa. The continent is emerging as a potential source of gas diversification for Europe, with new suppliers and growing LNG exports. While renewable energy development is crucial, natural gas can help reduce global coal use, aid Europe in replacing Russian gas, complement renewable energy, and provide critical revenues for the continent’s economic growth. Achieving a balance between energy security, climate change, and sustainable development is a challenge that African countries are grappling with as they seek a greater voice in international fora.

LNG AND FLNG ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 15

We have increased our offering in the LNG sector, and expect this to increase further as existing maintenance contracts are renewed.”

The FLNG vessels are set to commence production in 2023 and 2025 respectively.

Image Credit: Adobe Stock

EFFECTIVELY MONITORING COMPLICATED INFRASTRUCTURE

SINCE 2022, NIGERIA has not only dropped to the fourth position in terms of oil production, but continues to experience lows as it recorded a further month-on-month drop by 17.7% to 1.25 mn bpd in April. This is following 1.52 mn bpd production in March. The stark drops mostly point to the rising challenge of oil theft, especially in the Niger Delta region, spelling huge losses for Nigeria, international oil companies operating in the country, as well as indigenous operators.

Specialist service provider James Fisher AIS believes that technology can be the way out for Nigeria from this problem. In an

What is the digital twin technology?

Digital twin technology is an exact, virtual replica of a physical object, infrastructure, processes, systems, or environment that accurately reflects its real-world counterpart. It is designed to mirror a real-world object, capturing historical, current, and future status that helps in monitoring operations and simulating behaviours.

A digital twin is driven by a unique combination of reality data, real-time data and engineering data, to allow for effective asset management.

Various industries utilise digital twin technology, such as energy, manufacturing,

interview with Oil Review Africa, Chinenye Amorha, business development manager at James Fisher, laid out how this can work on the ground.

interview with Oil Review Africa, Chinenye Amorha, business development manager at James Fisher, laid out how this can work on the ground.

R2S digital twin allows energy companies to improve asset productivity, increase safety and enhance collaboration.”

Chinenye Amorha, business development manager at James Fisher, explains the concept of digital twin technology and how it can be the answer to Nigeria’s O&G challenges.

INTERVIEW ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 16

Digital twin is driven by a unique combination of reality data, real-time data and engineering data.

Image Credit: Adobe Stock

construction, automotive, aerospace etc, to predict asset behaviours in different conditions and scenarios. James Fisher AIS’ R2S digital twin allows energy companies to improve asset productivity, increase safety and enhance collaboration for teams tasked with managing the asset through its lifecycle.

What contributed to Nigeria's falling behind as Africa's largest exporter? How can AIS’ digital twin technology help turn that around?

Nigeria is currently one of Africa’s largest crude oil exporters, but it has faced several challenges that have contributed to its fluctuating export. These include declining production, a lack of refining capacity, price volatility, infrastructure and regulatory challenges and an over-reliance on crude oil exports limiting some sectors of Nigeria’s economy.

To achieve the Nigerian government’s goal of meeting its OPEC production quota, it is paramount that critical infrastructure in the oil industry is effectively monitored and managed. This is where AIS’ digital twin technology – R2S – comes in. The R2S application provides remote visibility and management capabilities for assets, covering equipment, workforce, and the work environment.

With over 6,000 global users, from oil majors to EPCs, validating the effectiveness of R2S, the Nigerian oil and gas industry regulator – NUPRC, the National Oil company – NNPC, and its Joint Venture asset owners, will significantly benefit from deploying R2S technology that centralises all information gathered from the assets, for monitoring and regulatory compliance.

How challenging is it to set up a digital twin infrastructure in Nigeria?

Physical infrastructure and adequate data centres are required to setup a digital twin infrastructure. Progress has been made in the region to improve this, but limited access to stable power and available internet connectivity in certain areas still needs to be addressed. The country is also contending with a skills gap, so there is a real necessity to invest in training programmes to develop local talent, or partner with educational institutions to foster skills development. To make this vision a reality, we are delivering a training school in Angola that equips new industry recruits with the digital skills needed to overcome Nigeria’s digital transformation gaps to operate oil and gas assets efficiently.

Additionally, having to engage with government agencies to ensure compliance with local laws, policies and regulations relating to cybersecurity, intellectual property, data privacy and technology deployment compounds this. This is key for organisations operating in a highly regulated oil industry and requiring data sovereignty.

Digital twin infrastructure also requires adequate funding and investment to setup and maintain. To attract investment, investors must clearly see market potential and longterm sustainability.

Whilst challenges are present, we have found that our unique model of hand-in-hand

working with clients through every step of the creation, roll out, and sustaining of the digital twin effectively mitigates the majority of these issues.

Will this medium contribute to avoiding oil theft and vandalism?

Yes. By integrating sensors and IoT devices within the digital twin infrastructure for production equipment, pipelines, and storage facilities, operators can immediately receive alerts in the event of any unauthorised access, abnormal activities, or tampering. This allows for swift response and deployment of mitigating measures to forestall theft and vandalism.

Keeping security at the forefront of operations, utilising anomaly detection and predictive analysis means that historical records can be analysed to identify patterns and correlations that may indicate suspicious behaviour, detect potential vulnerabilities, and predict potential security risk. This makes it possible to proactively deploy preventive measures to secure the assets.

AIS’ R2S can be used as part of a combinations of technologies to help simulate different scenarios to assess vulnerabilities of the oil asset to potential theft and vandalism. This allows operators to identify unprotected points, evaluate the effectiveness of security measures and implement necessary improvements to deter potential threats and enhance security.

In what ways can the digital twin technology make a difference on the sustainability front?

Digital twins enable optimised resource management by gathering and analysing data across various stages of production, transportation, and logistics. By using applications such as R2S, companies can reveal inefficiencies, reduce waste, and overall, enhance sustainability performance by minimising the environmental impact from an operating asset.

By integrating environmental monitoring systems with air quality, water quality and weather sensors, environmental data provides an organisation with a holistic overview of its assets, allowing for remote inspections and increased efficiencies. Given that digital twins allow for continuous asset performance monitoring, predictive maintenance is also possible. Using this proactive approach helps prevent unexpected shutdowns, minimise downtime, and optimise maintenance schedules.

INTERVIEW ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 17

As part of combinations of technologies, R2S can help simulate different scenarios to assess vulnerabilities of the oil asset.”

Chinenye Amorha, business development manager at James Fisher.

Image

Credit: James Fisher AIS

HARNESSING NATURAL CAPITAL

Africa continues to explore its oil reserves while embracing gas as a means of gradual and just transition.

AROUND 600 MN people in Africa still do not have access to electricity. A sustainable future for the continent thus entails practical solutions of exploring a diverse energy mix. To eradicate Africa’s energy poverty, the role of natural gas remains significant. It recognises gas resources as a means for just transition to somewhat be in tune with the world’s race to net zero goals.

Africa’s rigorous gas monetisation measures are evident in projects such as the 5.2-mn-ton per annum Angola Liquefied Natural Gas development and Chevron’s Sanha Lean Gas project; Mozambique LNG project; Greater Tortue Ahmeyim on the maritime border of Mauritania and Senegal; Yakaar-Teranga Phase 1 in ultra-deepwater in Senegal; BirAllah in Mauritania; Orca projects offshore SenegalMauritania; Brulpadda and Luiperd gas fields offshore South Africa, and the recently discovered Graff, Venus and Jonker finds offshore Namibia, among others.

According to a recent report from Reuters, in a bid to curb a dire power crisis, South Africa is now looking to auction at least 10 new onshore blocks for shale gas exploration in the Karoo region. In a first for the country, the competitive auction is expected in 2024 or 2025 once the bid round is announced.

"We are potentially looking at a minimum of about 10 shale gas blocks in the Karoo that will be

released through competitive bidding," said Bongani Sayidini, chief operating officer at the Petroleum Agency of South Africa (PASA). Sayidini said that new shale blocks offered will be smaller to increase participation.

According to PASA, the Karoo Basin is rich in 209 tn cu/ft of technically recoverable shale gas resources. Last year, the Academy of Sciences of South Africa released a Karoo shale gas action plan that said even 5 tn cu/ft would suffice a 1,000 MW to 2,000 MW gas-fired power plant to supply electricity for as long as 30 years.

If the expected amount of resources are found, first gas output can take a decade or more.

Africa, however, continues to explore its oil reserves while embracing gas as a means of gradual and just transition. According to a recent report, ‘The State of African Energy Q1 2023’ by the African Energy Chamber, much of the remaining oil this year will come from subSaharan countries like Gabon, Chad, Congo, Ghana, and Equatorial Guinea.

While Nigeria and Angola, along with Libya, Algeria and Egypt, will continue to be the

Africa’s rigorous gas monetisation measures are evident in a flurry of projects from Mozambique LNG to Greater Tortue Ahmeyim.”

GAS AND EP ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 18

To eradicate Africa’s energy poverty, the role of natural gas remains significant.

Image Credit: Adobe Stock

frontrunners in exploration and production activities, the subSaharan countries will rise to prominence as well.

Although Gabon is lagging behind its 220,000-bopd-by-2023 target, it is not doing badly at 200,000 bpd in April. This marked improvement can be attributed to Perenco and BW Energy. If the Gabonese government keeps attracting foreign investment and further

offshore deepwater exploration, the country might reach new heights.

Landlocked Chad holds approximately 1.5 bn barrels of crude oil reserves and relies on pipelines for export. It recently signed up to a project to erect a network of three multinational pipeline systems linking 11 different countries. If successful, the project can reduce the country’s dependence on refined petroleum imports.

Ghana has become one of the most attractive prospects in the sub-Saharan region as the Petroleum Commission of Ghana is coming up with lucrative measures for operators such as offering a sliding taxation scale, on which ultra-deep wells would see the lowest tax rate.

Sub-Saharan Africa’s third largest oil producer, Congo is

nearing closure on a new production-sharing deal with Chevron and Angola’s Sonangol EP concerning an offshore oil block shared by both countries.

In February, the Ministry of Mines and Hydrocarbons of

Equatorial Guinea signed three production-sharing contracts with Panoro Energy and the Africa Oil Corporation, starting a new chapter of exploration and production for the West African nation.

GAS AND EP ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 19

Much of the oil this year will come from sub-Saharan countries.

Image Credit: Adobe Stock

Ghana has become one of the most attractive prospects in the sub-Saharan region.”

GOOD I NVESTMENT PROSPECTS IN GAS

THE PETROLEUM AGENCY SA promotes exploration for onshore and offshore oil and gas resources and their optimal development. It is mandated in terms of Section 70 of the Mineral and Petroleum Resources Development Act 28 of 2002 (MPRDA) by the Minister of Mineral Resources and Energy to promote, facilitate and regulate the exploration and sustainable development of oil and gas to advance energy security in South Africa.

The agency processes applications for petroleum rights and permits, and makes recommendations to the minister on the awarding of petroleum rights. It is responsible for the compliance monitoring of oil and gas exploration and production activities in the country, and serves as the custodian of the national petroleum (geological and geophysical) data.

Oil Review Africa spoke with chief operation officer, Bongani Sayidini about the status of gas exploration in South Africa.

South Africa is potentially endowed with oil and gas. The Petroleum Agency SA estimates that the country holds

approximately 60 trillion cubic feet (tcf) of prospective gas resources on the south, west and east coasts. Estimates for onshore are in excess of 200tcf of prospective shale gas resources, biogenic natural gas and coal-

“This is very significant gas potential that could aid energy security of supply in the country,” says Sayidini.

“The PetroSA Gas-to-Liquids (GTL) refinery in Mossel Bay –which produces petrol, diesel, paraffin and liquefied petroleum gas (LPG) as the main products –was sustained with 1.5tcf of gas over 28 years from 1992 to 2020. Furthermore, according to the National Development Plan, 20 gigawatts of electricity could be generated from 24tcf of gas, that is about half the current electricity generating capacity in the country. The exploration and exploitation of these prospective gas resources could thus aid the country’s transition toward net-zero carbon emissions by 2050, provided all other fundamentals to support the development of gas are in place,”

Sayidini mentions that a number of natural gas discoveries on- and offshore South Africa have been made recently and are currently in development or near development. These include the 3tcf gas and condensate discoveries in Block 11B/12B off the south coast by TotalEnergies and partners (Qatar Petroleum,

'Very significant gas potential'

he adds.

The Petroleum Agency SA believes South Africa's vast gas resources could lower the country's dependence on coal as well as address the energy crisis.

SPONSORED CONTENT ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 20

If discovered in sufficient quantities, South Africa’s gas could be exported as LNG for export to global markets, including to Europe.”

Bongani Sayidini, chief operation officer, Petroleum Agency SA

Image Credit: Petroleum Agency SA

and Main Street Ltd). TotalEnergies drilled two gas exploration wells in 2019 and 2020 in deepwater Block 11B/12B, some 175 kilometres from Mossel Bay. “TotalEnergies applied for the production right over Block 11B/12B on 5 September 2022, thus the company's exploration right is in the process of conversion to a production right, subject to environmental authorisation. It is envisaged that the first-phase development will consist of the drilling of at least three gas-producing wells, and the construction of subsea pipelines that will connect the wells to the existing FA Platform gas production facility. Subject to successful negotiations for gas offtake, the first phase of this project will enable the supply of gas and condensate to the GTL refinery in Mossel Bay by 2027. Production at the GTL refinery ceased in 2020 due to depleting gas reserves. The second phase of the project envisages the drilling of at least 10 additional wells, and the construction of a new gas production facility to process up to 560 MMscf/d of gas – enough to power a plant of up to 3 000MW,” he explains.

“Some 400 billion cubic feet of natural gas and helium have also been discovered by Tetra4 –which is wholly owned by Renergen –in Virginia, near Welkom in the Free State. Tetra4 has continued with the second-phase drilling campaign, with at least 20 wells drilled in 2021-22. It has also continued with the phased construction of a liquid helium and liquefied natural gas (LNG) plant following the successful commissioning of the first phase in September 2022, and has started supplying LNG to the market. This followed a successful pilot phase of the Virginia gas project that consisted of completing existing wells/gas blowers and constructing a compressed natural gas plant to fuel 10 mega buses.”

Active explorations

In addition to these new discoveries, says Sayidini, there are at least 30 active exploration rights on and offshore South Africa in various stages of exploration.

The Gazania-1 well was drilled by Eco Atlantic Oil and Gas and its joint venture partners (Africa Energy, Panoro and Crown Energy) in Block 2B off the west coast in October to November 2022. Unfortunately, the well did not intersect commercial hydrocarbons.

“Another exploration right that is at an advanced stage of exploration is over Block 5/6/7 off the west coast, held by TotalEnergies, Shell and PetroSA. The JV partners acquired about 10 000 square kilometres of 3D seismic data in 2019. That seismic data has been

processed and interpreted, leading to the identification of various prospects for drilling. The partners are expected to drill wells in the block in 2023/24.”

African opportunity

The European gas crisis, brought on by Russia's war in Ukraine, presents an opportunity for African countries with natural gas potential. “If discovered in sufficient quantities, South Africa’s gas could be exported as LNG for export to global markets, including to Europe,” Sayidini concurs. “Furthermore, massive gas discoveries have already been made in the Rovuma Basin, offshore Mozambique, and LNG exportation from Mozambique to the global markets started in 2022.

“Significant light oil and gas discoveries were also made in Namibia in early 2022 by Shell and partners through the Graff-1 and 2 wells, and TotalEnergies and partners through the Venus-1 well. Once separated from the light oil, Namibian gas will also likely be exported to global markets as LNG.”

Shale benefits

South Africa potentially hosts large shale gas resources as well. Sayidini reveals that the United States Energy Information Administration estimates the South African Karoo basin potentially holds 390tcf of technically recoverable shale gas resources. “Subsequent resource evaluation by the Petroleum Agency SA has resulted in a recoverable resource estimate of 205tcf. The exploitation of such a large amount of indigenous gas holds many potential benefits for South Africa in terms of energy security, economic growth and job creation.”

There have, however, been concerns raised by communities in the Karoo about the negative impacts of fracking for shale in the region – particularly the impact on scarce water resources. Sayidini says the Petroleum Agency SA is well aware of these concerns and others: “The use of large amounts of water and production of wastewater, induced seismicity, greenhouse gas emissions and groundwater contamination are real risks associated with hydraulic fracturing technology, therefore communities are justified in being concerned. These risks can be mitigated through appropriate regulations, covering the full shale gas life cycle.

“Indeed, hydraulic fracturing has been used in the oil and gas industry for several decades and, in the last 20 years, together with the practice of horizontal drilling, has been

instrumental in making the exploitation of unconventional resources technically and economically viable,” he adds.

The Petroleum Agency SA believes shale gas could be part of the country's answer to lowering its dependence on coal. “South Africa heavily relies on coal as a primary energy source, and accounts for about 75% of the country’s electricity generation. As a result, South Africa is ranked among the highest carbon dioxide–emitting countries globally,” notes Sayidini. “The exploitation of shale gas could reduce the country’s carbon dioxide emissions, and thus its contribution to climate change. Furthermore, the exploitation of such a large amount of shale gas could change the country’s energy landscape and potentially address the energy crisis.”

'Attractive option for investors'

Indeed, thanks to South Africa's vast potential, gas seems to be an attractive option for investors – even more so due to the country's fairly straightforward and low-cost licensing of petroleum rights governed by the MPRDA and related regulations.

“Furthermore, South Africa has a highly attractive petroleum fiscal regime that is relatively simple, based on royalty and income tax, linked to profits. It is neutral, with the state take limited to the available economic rent, thus ensuring a satisfactory return on investment,” Sayidini adds.

“Another attractive feature of the petroleum fiscal regime of South Africa is the fiscal stability that is provided for in the Income Tax Act No. 58 of 1962 with its various amendments. In terms of the 10th Schedule of the Act, the minister may enter into a binding agreement with any oil and gas company in respect of an oil and gas right held by that company, and that agreement will guarantee that the provisions of the Schedule (as at the date on which the agreement was concluded) will apply in respect of that right as long as the right is held by the company.”

The petroleum regulatory environment is expected to change in South Africa in the near future, Sayidini adds. “The Upstream Petroleum Resources Development Bill, which was gazetted at the end of 2019 by Minister Gwede Mantashe, is currently before parliament for processing. This bill separates the regulations of petroleum from the combined law, which is currently regulating both minerals and oil and gas.”

For more information, visit www.petroleumagencysa.com

SPONSORED CONTENT ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 21

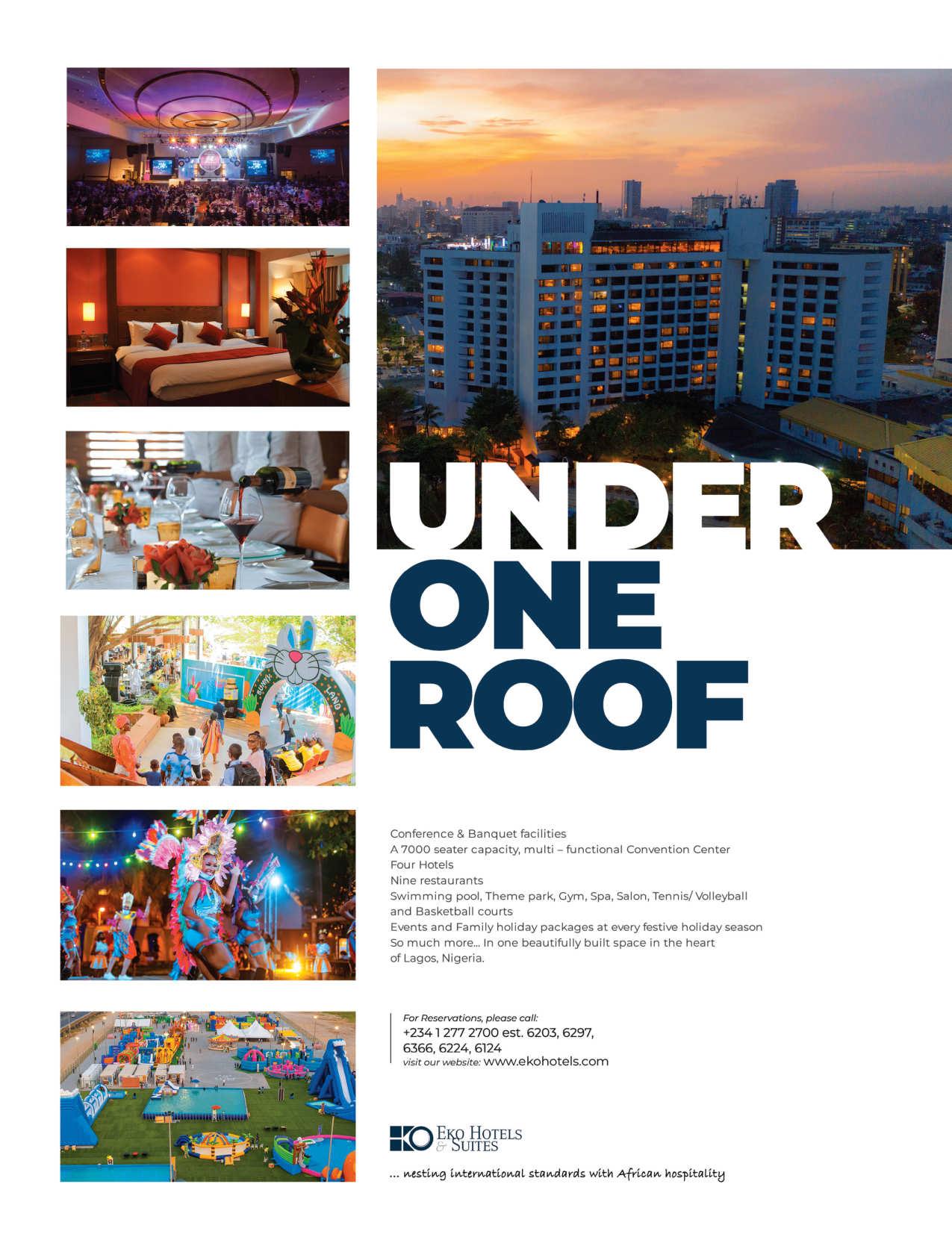

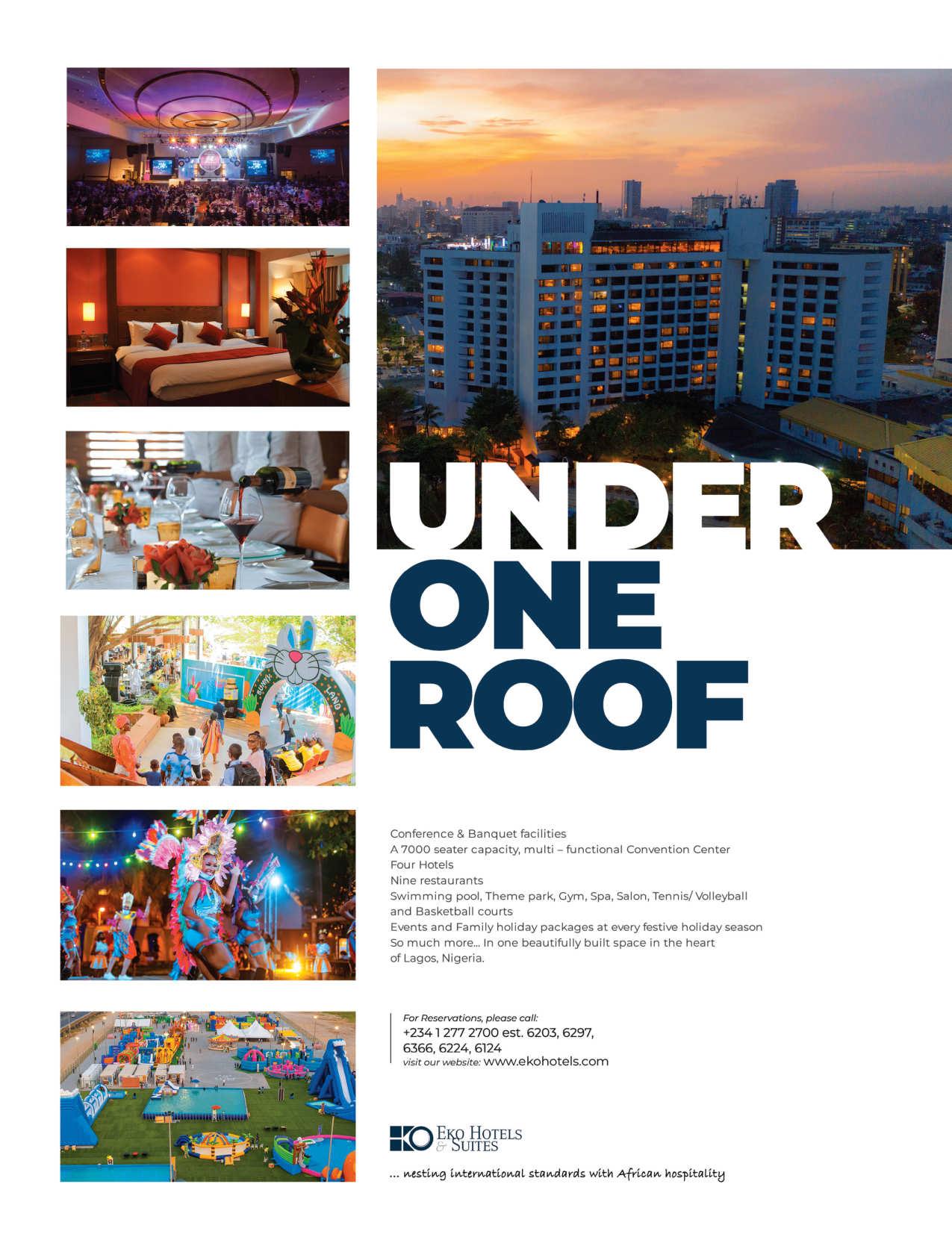

POWERING NIGERIA’S SUSTAINABLE ENERGY FUTURE

Taking place from 9-13 July at the International Conference Centre, Abuja, the NOG Energy Week Conference & Exhibition, previously known as Nigeria Oil & Gas (NOG) Conference & Exhibition, will facilitate multilateral dialogue, foster multi stakeholder engagement and enable deal making within the energy industry.

IT IS A time of momentous transformation for Nigeria as it navigates its energy evolution pathway underpinned by ‘The Decade of Gas’ and looks toward a more just, affordable and sustainable energy system.

With this view, NOG Energy Week has adapted its narrative to enable a much more robust and integrated conversation –exploring how Nigeria can truly galvanise its universal energy mix. It will focus on the strategies that will be employed by the Nigerian government and private sector leaders to navigate the emerging business environment – helping to set the nation’s energy agenda for the next 12 months and beyond.

The NOG Energy Week International Exhibition is Nigeria’s most important oil, gas, LNG and energy exhibition, where energy professionals convene to exchange dialogue, showcase technological advancements, identify innovative solutions and forge business partnerships. With 350+ exhibiting companies, it is set to attract 5,000+ attendees from Africa, Middle East, Europe, Asia and the USA, creating an unparalleled business opportunity to tap into this vital market.

The Strategic Conference will review Nigeria’s positioning within the evolving global energy landscape, with a focus on

emerging opportunities to transform its energy industry through robust legislation, technology and innovation, incountry capacity development and energy self-sufficiency targets.

Keynote speakers include Mele Kyari, Group CEO, NNPC Limited; Rose Ndong, executive commissioner – Exploration & Acreage Management Nigerian

Upstream Petroleum Resources Commission; Abdulrassaq Isa, chairman, Independent Producer Group; Richard Kennedy, chairman & managing director, Chevron Nigeria/Mid-Africa Business Unit & chairman, OPTS; Elohor Aiboni, managing director, Shell Nigeria’s Exploration & Production Company; Philip Mshelbila, managing director and chief executive, Nigeria LNG, and many other industry leaders.

The Nigerian Content Seminar, organised in collaboration with the Nigerian Content Development and Monitoring Board (NCDMB), will enable participants to have a deeper understanding of the NOGIC Act and its accompanying opportunities.

This year’s Technical Seminar

themed ‘Advancing Technical Skills for Energy Security & Transformation' is a dedicated knowledge exchange and networking hub for technical workforce professionals in the energy industry.

Join us in July to network with stakeholders, policy makers, energy leaders, industry professionals and financiers from around the globe across the energy spectrum and discuss the industry’s most immediate challenges and ambitions to achieve energy security for the nation, while navigating the journey towards a secure, sustainable and just energy transition for Nigeria.

For further information, see the website at www.nogenergyweek.com

NOG Energy Week has adapted its narrative to enable a much more robust and integrated conversation.”

NOG ENERGY WEEK ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 22

The show is expected to attract more than 5,000 visitors and 350 exhibiting companies.

Image Credit: dmg events

FOUNDATION OF THE OIL & GAS INDU STRY

From production facilities and liquefaction plants to refineries and storage tanks, the O&G infrastructure involves several aspects for smooth operations.

SUCCESSFUL PRODUCTION OF oil

and gas can only be reached following an elaborate process, which requires proper infrastructure. An oil and gas set up includes production facilities, liquefaction plants, refineries, pipelines and storage tanks, among others.

The extracted oil is transported in oil pipelines or shuttle tankers, and dry gas in gas pipelines. In some scenarios, the treatment of the gas depends on the requirements of the end user and is distributed directly to national gas distribution systems. Such production facilities, often called topsides, are usually deck structures installed on fixed or floating substructures. They can be simple wellhead platforms or facilities with full production and processing capabilities, containing equipment for production drilling, extraction and processing as well as storage

and export of oil and natural gas, with all required utility and process support systems. Often, they will be having living quarters for the offshore workforce as well.

Over the years, a powerful digital structure has also grown to support and simplify the traditional constructions of the sector. These are evident in the dynamic advances of geophysics, geosciences or asset management due to incredible remote monitoring technologies.

A 1000m-rated Saab Seaeye Falcon DR robotic vehicle is highly capable of supporting

archaeological research and offshore energy. It includes a Tritech Super SeaPrince sonar and skid-mounted five function manipulator and rope cutter.

The Falcon package has a proven record globally in many marine archaeological missions involving filming, recording, surveying and delicately recovering artefacts when appropriate. During diving operations, the Falcon can helpfully preview dive sites, watch over divers and save time by transporting tools and materials back and forth. It has a reliability record covering over a

million hours underwater. Its success comes from having the power and intelligent control to handle a wide range of resources for undertaking numerous intricate and demanding tasks in strong currents and turbulent waters.

Just a metre in size, the Falcon is easily manhandled, and its iCON intelligent control architecture, combined with five powerful thrusters, allows precise manoeuvrability amongst complex structures, while loaded with various cameras, sensors and tooling, typically found on much larger robotic vehicles.

iCON intelligent control architecture, combined with five powerful thrusters, allows precise manoeuvrability amongst complex structures.”

OFFSHORE CONSTRUCTION ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 24

The Falcon package has a proven record globally in many marine archaeological missions.

Image Credit: Deep Sea Technology

Pipelines are indispensable to the oil and gas setup, and are basically its driving force. Of the latest pipelines developments in Africa, Agogo Integrated West Hub Development Project, offshore Angola, remains significant. With production capacity expected to reach as high as 175,000 bpd, the project will be supported by flexible pipes from TechnipFMC, under its contract with Azule Energy.

The contract is one of

TechnipFMC’s largest ever awards for flexible pipe in West Africa, and covers the engineering, procurement, and supply of jumpers, flowlines, risers, and all associated ancillary equipment. The flexible pipe will connect the new Agogo facility to the subsea production systems.

Azule Energy, a bp and Eni company, is the operator of Block 15/06 in Angola offshore, partnering with Sonangol P&P and SSI Fifteen Limited.

Jonathan Landes, president, subsea at TechnipFMC, commented, “Our ability to meet Azule’s flexible pipe needs, which allows for optimised riser and flowline system configuration, was instrumental in winning this award. This is another example of our unique capability to support fast-track greenfield developments, and we are excited to be supporting Azule Energy and its partners on this project.”

A megaproject that includes giants such as Baker Hughes, Saipem and Subsea7, among others, Agogo bears the capacity of 230 mmscfpd of gas injection as well. For the provision, operation and maintenance of a FPSO asset for the project, Yinson Production entered into a contract with Azule. YP CEO Flemming Grønnegaard,

commented, “We are committed to delivering value-added results for our client, whilst implementing a low emission design that helps to mitigate climate change. Together, we hope to pioneer some sustainable technologies such as carbon capture that we believe can pave the way for the decarbonisation of the FPSO industry.”

in offshore safety: Reflex Marineʼs award-winning work basket has completed 100 projects.

Leading

REFLEX MARINE’S STORM-WORK suspended work basket was successfully employed in its 100th offshore project in October 2020.

The STORM-WORK was designed specifically for offshore industrial work activities and was very well received by offshore operators across industries – heavylift, decommissioning, oil & gas, and offshore wind. ConocoPhillips in Australia is using the customised enlarged version of STORMWORK while the standard units have been employed in multiple projects throughout Europe, among others, with Seaway7.

The design, safeguarding both the workers inside the basket and the assets worked on thanks to the soft-touch features and contoured shape, is praised by users worldwide. The small footprint and light weight allow for improved manoeuvring, while the highly durable, low-maintenance materials used ensure long unit lifespan.

“The unit is excellent for accessing areas with obstacles and tight landing spaces,”

comments a STORM-WORK user from Boskalis.

Reflex Marine’s innovative work basket design has been recognised by industrial engineering body LEEA with an award in the

Safety category confirming the outstanding crew protection features and safety benefits.

STORM-WORK is available for purchase and hire and can be customised to meet the required size and capacity.

OFFSHORE CONSTRUCTION ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 25

TechnipFMC’s flexible pipe will connect the new Agogo facility to the subsea production systems.”

The pipelines will cover the engineering, procurement, and supply of jumpers, flowlines, risers, and all associated ancillary equipment.

Image

Credit: Adobe Stock

The Reflex Marine STORM-WORK suspended work basket has been recognised by the LEEA with a safety award.

Image Credit: Reflex Marine

ROAD TO SUSTAINABLE AFRICAN UPSTREAM

AS AFRICA CLAIMS its rights to develop its natural resources for the benefit of its people, the continent’s regulators and operators are also increasingly focused on building a more sustainable industry.

In its efforts to remain competitive and attract muchneeded capital, the industry must find ways to reduce flaring, which amounted to over 29 Bcm last year according to World Bank data. This is equivalent to some US$3.3bn of natural gas flared and wasted by Africanproducing countries last year, while generating significant amounts of greenhouse gas (GHG) emissions.

Matter of competitiveness

As the world embraces decarbonisation, oil & gas importing countries are increasingly paying attention to the carbon intensity of the

products they import and consume. Unfortunately, Africa remains a carbon-intensive continent whose oil production is heavily linked to GHG emissions. While the continent represents less than 10% of global oil production, it accounts for 20% of global flaring volumes.

Flaring in Africa

Africa’s flaring intensity, which measures the amount of gas flared per barrel of oil produced is amongst the highest in the world. Cameroon and the Democratic Republic of Congo flare over 25 cu/m of gas for every barrel they produce

according to World Bank data, followed by Tunisia (23.2 m3/bbl), Gabon (19.6 m3/bbl), Algeria (19.5 m3/bbl), and the Republic of Congo (18.2 m3/bbl).

In comparison, other established and emerging frontiers perform a lot better and can offer investors and consumers products that are a lot less carbon intensive. Saudi Arabia, the UAE, and Brazil flare on average less than 1 cu/m of gas per barrel they produce, for instance.

Thankfully, governments there have committed to eliminating routine flaring and are increasingly promoting the use of gas domestically to create a value chain that can absorb associated gas. Operators are also developing innovative business models and projects that can address the technological and economical challenges of tackling methane emissions from marginal and mature fields.

Independent operator

Perenco, the largest oil and gas producer in Central Africa, is leading such efforts in cooperation with regulators and industry stakeholders. Perenco’s approach has been to first anchor the development of its small gas reserves with the domestic power sector, and then diversify the products made from gas (LPG, CNG, LNG) in a second phase to ensure additional revenue streams and make its projects economically feasible.

The company’s latest such initiative is focused on Gabon, where it is currently building a 15,000 tons LPG plant at Batanga, progressing a 0.7 mtpa LNG export terminal at Cap Lopez, and planning a 21 MW gas-topower project at Mayumba in the country’s southern province.

Noticeable progress

The continent’s biggest oil & gas producers like Algeria, Nigeria, Libya, Egypt, and Angola, who represent most flaring volumes, are

FLARING ISSUE 3 2023 • WWW.OI LREVIEWAFRICA.COM 26

Africa’s flaring intensity is amongst the highest in the world.”

Image Credit: Adobe Stock

A report released by the Africa Oil Week dives deep into the continent’s flaring extent, and the measures initiated to reach zero routine flaring by 2030.

Africa accounts for 20% of global flaring volumes.

also stepping up efforts to capture associated gas and cut flaring.

Angola provides one of the best success stories, as its LNG export terminal at Soyo processes associated gas that would otherwise be flared. Since the facility restarted in 2016, it has resulted in very concrete reductions of the country’s flare volumes and flaring intensity.

Angola's flaring profile

Other large producers like Egypt and Algeria are currently investing in additional infrastructure and technologies to recover, capture and utilise their associated gas. Egypt’s flaring intensity currently stands at a 10-year low after investments in pipeline infrastructure and compression units by several operators that are now monetising their flared gas. The country is also a pioneer in the deployment of carbon capture initiatives on the continent, with pilot projects led by majors such as Eni and Shell.

North African producers currently have several opportunities to successfully monetise their associated gas given the extent of their existing infrastructure and the ability to inject gas into large export infrastructure to Europe.

Way forward

By and large, African oil and gas producing markets have recognised the need to reduce flaring and are taking actions towards decarbonising their value chain.

In fact, most producing countries on the continent have endorsed the World Bank’s Zero Routine Flaring by 2030 Initiative (ZRF), which commits governments and companies to stop routine flaring on greenfield oil projects and end routine flaring on existing oilfields by no later than 2030.