EGYPT’S LNG prospects

Libya’s position in global oil market Scale treatment solution for a project, offshore Angola Safety clothing, digitalisation, valves

WWW.OILREVIEWAFRICA.COM

VOLUME 18 | ISSUE 4 2023

Engineer Chris Mills from TUV SUD highlights effective flow management techniques, Pg 16

Egypt is a leading contender in meeting Europe's LNG needs.

EDITOR’S NOTE

IN THIS ISSUE, we follow Egypt on its impressive LNG trail as the Europe market continues to hold opportunities for Africa. The European Union is said to have become Egypt's largest trading partner. The country’s stronghold in the oil and gas industry can be especially accredited to its strategic location.

While it may not seem likely at the moment, Libya’s undeniable ‘natural prospectivity’ will dramatically expand production over the next decade. This can push it to become one of the forerunners in meeting Europe’s energy needs!

On the digitalisation front, African energy companies now have access to products with which they can streamline data management, promote collaboration among stakeholders, and make data-driven decisions. Turn the pages to catch all that and many more developments taking shape in Africa’s energy scene.

Madhurima Sengupta Editor

CONTENTS

Editor: Madhurima Sengupta

madhurima.sengupta@alaincharles.com

Editorial and Design team: Prashanth AP, Sania Aziz, Miriam Brtkova, Robert Daniels, Shivani Dhruv, Matthew Hayhoe, Leah Kelly, Rahul Puthenveedu, Madhuri Ramesh, Louise Waters and Minhaj Zia

Publisher: Nick Fordham

Head of Sales: Vinay Nair

E-mail: vinay.nair@alaincharles.com

International Representatives

IndiaTanmay Mishra

NigeriaBola Olowo

South AfricaSally Young

Head Office:

Alain Charles Publishing Ltd University House, 11-13 Lower Grosvenor Place, London SW1W 0EX, United Kingdom

Tel: +44 (0) 20 7834 7676 Fax: +44 (0) 20 7973 0076

Middle East Regional Office:

Alain Charles Middle East FZ-LLC Office L2-112, Loft Office 2, Entrance B P.O. Box 502207, Dubai Media City, UAE

Tel: +971 4 448 9260 Fax: +971 4 448 9261

Production: Rinta Denil, Ranjith Ekambaram, Eugenia Nelly Mendes and Infant Prakash

E-mail: production@alaincharles.com

Subscriptions: circulation@alaincharles.com

Chairman: Derek Fordham

Printed by: Buxton Press

Printed in: July

© Oil Review Africa ISSN: 0-9552126-1-8

Serving the world of business

Emerson's solutions for asset performance management.

NEWS 4 Calendar of events Diary dates of executives 6 News Africa Oil Week 2023, TotalEnergies-

partnership,

milestone

COVER STORY 10 Egypt Booming LNG market for home and abroad SPECIAL FEATURES 12 Libya Can Libya achieve its hydrogen potential? 16 Flow management

of changing field conditions on flow measurement 22

Clothing

TECHNOLOGY AND OPERATIONS 20 Scale Inhibition

perfect compatibility 26 Digitalisation

transformation INTERVIEW 32

clarity for peak performance

SONATRACH

Angola and DRC’s

deal, Phase 2 of Mauritania’s GTA project

Impact

Safety

Shifts in personal protective equipment market

Achieving

Discovering Africa’s digital energy

Delivering focus and

ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 3

(Image Credit: Adobe Stock)

Executives Calendar 2023

AUGUST

31 Jul-2 Aug SPE Nigeria Lagos

https://www.naice.spenigeriacouncil.org/

SEPTEMBER

5-8 Gastech Singapore

https://www.gastechevent.com/

5-8 SPE Offshore Europe Aberdeen

https://www.offshore-europe.co.uk/

17-21 24th World Petroleum Congress Calgary, Canada

https://www.24wpc.com/

19-21 Nigeria Energy Lagos

https://www.nigeria-energy.com/

27-28 Mozambique Gas & Energy Summit Maputo

https://www.mozambiqueenergysummit.com/

OCTOBER

2-5 ADIPEC

Abu Dhabi

www.adipec.com

9-13 Africa Oil Week Cape Town

www.africa-oilweek.com

Readers should verify dates and location with sponsoring organisations, as this information is sometimes subject to change.

OE23 to explore scenarios of CCS and hydrogen application

ENERGY INDUSTRY LEADERS are to set out how the sector can overcome challenges posed by the implementation of carbon capture storage (CCS) and the use of hydrogen at SPE Offshore Europe 2023 (OE23).

A series of technical papers and panel sessions on the topics will be on offer to help the industry as it transitions towards net zero. The theme of the conference at this year’s 50th anniversary OE23, which will be held at P&J Live, Aberdeen from 5-8 September 2023, is ‘Securing sustainable and equitable energy for the next 50 years and beyond.’

A paper by Petronas will discuss the possibility of repurposing existing hydrocarbon pipelines for CO2 transportation. EBN BV will set out how project design and operational philosophy hurdles were tackled on two large-scale CCS projects in the Netherlands.

Another paper by EBN BV will analyse the storing of CO2 in a depleted gas field in the Netherlands. The Boston Consulting Group will detail how combining extensive research of limestone and steel industry with CO2 storage physics can enable the acceleration of mineralisation in the reservoir from approximately 100 years to two years, rapidly accelerating the permanent CO2 storage process.

Hydrogen challenges are also set to take up a headline position on the OE23 agenda. Producing, transporting, storing and using low-carbon hydrogen safely and cost-effectively will be essential to enable the UK’s net zero commitment to be met. However, numerous technical challenges need to be overcome to enable hydrogen to be deployed at scale.

Environmental Resources Management will present the results of industrial trials commissioned by the UK Government, Scottish Government and Scottish Ports to investigate the technical and commercial feasibility of exporting hydrogen from

offshore wind in the North Sea by using liquid organic hydrogen carriers (LOHC) to industrial European demand centres.

A paper by Kent plc will present recent modelling work carried out supporting a Dutch North Sea operator to understand the change in risk on their production platform due to the newly produced hydrogen passing through it.

Hydrogen technology and know-how will also be showcased on the exhibition floor in the Hydrogen Hub, sponsored by ABB. The full conference programme can be found at: www.offshore-europe.co.uk

ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM EVENTS CALENDAR 4

Image Credit: Adobe Stock

A series of technical papers and panel sessions on energy transition will be on offer.

Well intervention spending to top US$58bn in 2023

THE WELL INTERVENTION market is looking to get a healthy boost as oil and gas production companies continue to look for cost-efficient methods for increasing their outputs.

Spending on interventions is projected to jump by almost 20% this year to a total of US$58bn, with Rystad Energy’s model indicating that this is the start of a surge in the coming years as the focus on energy efficiency intensifies.

The intervention rate – how many oil and gas wells go through the intervention process – is forecast to reach 17% by 2027, totalling around 260,000 wells globally.

Onshore interventions in Asia, South America and Africa will lead the 9% growth in activities relating to intervention

during 2024, while North America is projected to account for 64% of the total oil and gas wells ready for intervention in 2027.

“As oil demand picks up in the second half of this year, operators will look to ramp up production from existing fields, and well

Africa Oil announces increased operator interest for Block 3B/4B

interventions will be a vital piece of the puzzle,” said Jenny Feng, supply chain analyst at Rystad Energy.

“As a quick, efficient, and cost-effective method of maximising existing resources, interventions are going to be a hot topic in the years to come.”

Africa Oil Week to welcome world leaders in a bid to chart Africaʼs energy destiny

INDUSTRY LEADERS FROM across the international market, government representatives, and policymakers will converge in Cape Town in October this year when Africa Oil Week (AOW) 2023 takes place.

The theme for the conference this year is ‘Maximising Africa’s

Natural Resources in the Global Energy Transition’.

Billed as ‘Africa’s leading Upstream Event’, the conference brings together major global decision makers to help map a sustainable, realistic transition path that supports Africa’s energy needs, socio-economic growth,

and ensures Africa retains control of its natural resources.

“We are proud to provide a platform to discuss how Africa can develop its oil and gas sector through strong, sustainable carbon-management strategies,” said Ore Onagbesan, head of energy for AOE.

“We remain committed to this event – as we have been for the past 29 years – as an energy forum that makes a positive global impact, and which leaves a legacy of socio-economic development across the African continent.”

More than 2,000 industry leaders are expected to attend AOW taking place from 9-13 October, 2023 at the Cape Town International Conference Centre.

AFRICA OIL CORP. has announced is has entered an agreement to increase its operated working interest (WI) in Block 3B/4B, located in the Orange Basin offshore South Africa, for an additional 6.25% interest.

The Company has signed a legally binding Letter of Intent (LOI) with Azinam Limited, a wholly owned subsidiary of Eco Oil & Gas Ltd. (Eco), to acquire the 6.25% interest for a total cash consideration of US$10.5mn.

The Company and its Block 3B/4B partners are progressing plans to conduct a two-well campaign on the block and are in discussions with various potential partners to farm out up to a 55% gross working interest in the Block.

The Company and its partners have also selected a leading South African environmental consulting firm to conduct a comprehensive Environmental and Social Impact Assessment process in preparation for permitting and drilling activity on the Block.

Block 3B/4B covers an area of 17,581 km sq within the Orange Basin offshore South Africa, lying southeast and on trend with a number of oil discoveries including Venus and Graff. RISC Advisory UK reviewed the prospective resources and probability of geological success of 24 exploration prospects within Block 3B/4B. and has reported total unrisked gross P50 prospective resources of approximately 4 billion barrels of oil equivalent (boe).

ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM NEWS 6

More than 2,000 industry leader are expected to attended AOW this year.

Image Credit: Rystad Energy

Image Credit: Alain Charles Publishing

The graph shows the number of wells and the intervention rate per region.

Tullow announces successful startup of JSE

TULLOW HAS ANNOUCNED the successful start-up of the Jubilee South East (JSE) Project, offshore Ghana.

Alongside its joint venture partners Kosmos Energy, Ghana National Petroleum Corporation, Petro SA and Jubilee Oil Holidays the first JSE production well has been brought onstream, with a further two producers and one water injector expected onstream this year to help sustain gross Jubilee production of more than 100,000 bopd.

Tullow and its partners have invested c.$1bn over the last three years on the JSE Project to drill wells and install the infrastructure needed to bring previously undeveloped reserves to production. The project has advanced the use of local suppliers and the majority of the complex offshore infrastructure has been fabricated by local companies in Ghana, with more than 90% local workforce.

Rahul Dhir, chief executive officer of Tullow, said, “Through our strong project management and operating capability, we have delivered a complex offshore development which is one of the key catalysts to unlock value for our business. We are well positioned for future growth with production ramping up in the second half of 2023 that will generate significant free cashflow.”

Dr Matthew Opoku Premper, minister of energy in Ghana, commented, “The approval of the Greater Jubilee Full Field Development Plan by the Ministry in October 2017 paved the way for investment in the development of the JSE project, which has now culminated in the delivery of the First Oil from the JSE area.”

TotalEnergies and SONATRACH strengthen gas partnership

TOTALENERGIES AND SONOTRACH have signed several agreements to strengthen the cooperation in the production of renewable energies.

The agreements state that further collaboration will ensure increased production of natural gas in Algeria, the delivery of liquefied natural gas (LNG) to Europe, and the development of renewables in Algeria.

Under the first agreement, the companies will pursue the investment programme already launched to increase the gas production of the Tin Fouyé Tabankort II (TFTII) and Tin Fouyé Tabankort Sud (TFT sud) fields, where the combined production is expected to exceed 100,000 boe per day by 2026, increasing the export of Algerian gas to the European market.

Under the second agreement, SONATRACH will deliver two million tons per year of LNG to TotalEnergies at the port of FosCavaou, France, from 2024, contributing to Europe’s energy security.

Finally, under the third agreement, the two companies

will cooperate to develop renewable energy projects in Algeria, specifically a project to solarise exploration and production sites, a study of the potential for a strong renewable market, and an R&D programme in low carbon energies and the energy transition.

ANPG signs concession contracts for production in Kwanza Basin

ANGOLA’S NATIONAL CONCESSIONAIRE, the National Oil, Gas and Biofuels Agency (ANPG) has signed four direct concession contracts for the production of oil blocks in the onshore Kwanza Basin.

Poised to increase exploration

activity and production, the concession involved Blocks KNON 2/11/12 and 16 and will service to encourage the participation of small- to medium-sized companies within Angola’s oil and gas space.

The signed concession

contracts signal new opportunities for the expansion of E&P activities in Angola while further consolidating the upstream potential that remains in the mature market.

Preceding the signing of the concession contracts, on 1 April, the ANPG announced the launch of Tender 2023 for the concession of an additional 12 onshore oil blocks in Angola’s onshore Lower Congo and Kwanza Basins.

Serving as sub-Saharan Africa’s largest oil producer and boasting oil and gas resources estimated at 8.2 billion barrels of proven crude oil reserves and 13.2 trillion cu/ft of proven natural gas, Angola’s upstream market is expected to record a growth of more than 1.5% between 2022 and 2027.

NEWS ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 7

Chairman and Ceo of TotalEnergies, Patrick Pouyanné, and chief executive officer of SONATRACH, Toufik Hakkar.

Image

Stock

The concession will encourage partcipation from small- to medium-sized companies within its oil and gas space.

Image Credit: TotalEnergies

Credit: Adobe

Angola and DRC to ink milestone oil and gas agreement for Chevron operated Block 14

ANGOLA AND THE Democratic Republic of Congo (DRC) are set to make history with the signing of an agreement for the development of Block 14 on Thursday 13 July in Kinshasa. The agreement, set to be signed by Diamantino Pedro Azevedo, Minister of Mineral Resources, Oil and Gas of the Republic of Angola and his DRC counterpart Minister Didier Budimbu Ntubuanga, will mark a major milestone in the collaboration between the two African nations and holds immense significance for both countries.

The signing of the agreement will authorise the Block's ownership, with the DRC and Angola taking a 30% stake each while global energy major – and block operator – Chevron taking a 40% stake. The signing puts an end to decades-long deliberations between the countries and is a testament to both Minister

Azevedo and Minister Ntubuanga’s commitment to advancing oil and gas exploration on the back of regional collaboration.

For Angola, the signing enables the country to leverage its experience as a major oil

Paratus and Ceragon sign partnership agreement

PANAFRICAN TELCO, PARATUS Group, announces a multi-year agreement with the global innovator and leading solutions provider of wireless communications, Ceragon Networks, to provide highcapacity wireless offshore communication solutions in Angola, Mozambique and Namibia.

producer to grow both its domestic market and the regional economy. For the DRC, this represents a breakthrough in its pursuit of new oil supplies and joint development opportunities enabling it to increase daily crude oil production.

Petro Matad gives update on Velociraptor-1 well results

PETRO MATAD, THE AIM quoted Mongolian oil company, has announced that the Velociraptor-1 exploration well in the Taats Basin of Block V located in central Mongolia reached a total depth of 1,500 m and wireline logging has been completed but

unfortunately all the reservoirs encountered were water bearing.

The well came in close to prognosis at all levels. The primary objective Late Jurassic/Early Cretaceous Undur Formation was encountered at 1,170 m and had good quality reservoir sands interbedded with shales over a c. 200 m interval. In the secondary objective Early Cretaceous Shinehudag Formation, three thick sand units were drilled with average porosity of around 18%. Good quality electric wireline logs confirmed both objectives to be water wet.

The well will now be plugged and abandoned and the rig will be demobilised. Operations were carried out on time and as budgeted with the full support and cooperation of the local community. The well results will now be incorporated into the company's interpretation of Block V before any further operational activity is undertaken in the area. Further operational updates will be provided in due course.

This effectively combines Ceragon’s world-class stabilising technology for offshore assets (rigs or floating production storage and offloading platforms commonly known as FPSOs) with the Paratus onshore network infrastructure to give customers an unequalled service for the fast and secure transmission of vital data.

The Ceragon technology connects offshore floating, rotating and/or navigating infrastructure through a uniquely stabilised live microwave link over distances of up to 100 km offshore to the Paratus pan-African network to provide unparalleled highquality connectivity. For oil and gas companies that have offshore infrastructure, high levels of risk prevail in a harsh oceanic environment, making reliable and resilient communications infrastructure an imperative.

“This is the fusion of two massive players whereby the combined strengths of both operators will be offered as a compelling solution for any energy or mining company that has offshore assets and needs to communicate, monitor, and survey their equipment and data at any time,” explained Adam Torry, oil and gas global sales manager at Ceragon.

ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM NEWS 8

Good quality electric wireline logs confirmed both objectives to be water wet.

Image Credit: African Energy Chamber

Image Credit: Petro Matad

The agreement will solidify Angola’s pivotal role in fostering collaboration and partnership across Africa.

Jade initiates

2D seismic programme at TTCBM gas project

JADE GAS HOLDINGS has advised that the planned 2D seismic program has commenced at the flagship Tavan Tolgoi Coal Bed Methane Project (TTCBM) in the south Gobi region of Mongolia

2D seismic survey

The 2D seismic survey will further augment the extensive data set that Jade has obtained through its exploration activities in the Red Lake area and beyond over the last few years, and incorporates learnings from a seismic programme undertaken by a previous operator.

All regulatory and access requirements have been met, with local Mongolian seismic operator, Geosignals LLC, mobilising crew and equipment, including vibroseis units and wireless recording equipment, from Ulaanbaatar to the TTCBM Project site in the South Gobi region of Mongolia.

Commenting on the Seismic campaign, Jade executive director, Joe Burke, said, “The data captured under this Seismic programme is an important step to assist our technical team as they continue planning for the upcoming pilot production drilling later this year.

“The Company has delivered outstanding gas performance results from the Red Lake gas field, and as we move forward with larger scale works, Jade continues to demonstrate the near-term and significant clean energy potential for Mongolia and our potential customers.”

Jade Gas Holdings Limited is a gas exploration company focused on the coal bed methane (CBM) potential of Mongolia.

Strategies to empower SMEs in Angolan oil & g as industry

AS ANGOLA TARGETS increased E&P activities in 2023 and beyond, several strategies can be deployed to advance the participation of small-to-medium enterprises (SME) across the evolving oil and gas industry.

Angola’s hydrocarbon market has experienced remarkable growth since the initial discovery of oil and gas in 1955, emerging as the biggest oil producer in Africa in 2023. While much of the industry has been largely dominated by global energy majors such as ExxonMobil, Azule Energy, Chevron and TotalEnergies – which celebrates 70 years of active participation in the country this year – working in close collaboration with the government, the future of the industry and its contribution to the economy will largely depend

on the participation of SMEs.

A traditionally underestimated corporate group, SMEs bring to the sector fresh perspectives, innovation and diversification, while in turn deliver newfound economic contributions through job creation, supply chain development and market growth.

Introducing new ideas, business models and practices, SMEs foster a more dynamic and competitive market environment. As Angola enters into a new era of E&P growth, several strategies can be deployed to enhance the participation of SMEs across the industry.

Mauritania's GTA Project Phase 2 to kick off in 2025

AS THE FIRST phase of the Grand Tortue Ahmeyim (GTA) gas project reaches 90% completion, and first gas extraction is targeted for the end of Q4 2023, Mauritania and Senegal are already looking ahead to the next stage, which is

expected to commence between 2024 and 2025.

The Ministry plans to start phase 2 in 2025, and expect total completion in 2027, Lehbib Khroumbaly, advisor on upstream sector at the Ministry of Petroleum, Energy, and Mines

of Mauritania, told to Energy Capital & Power.

GTA is located 120 km off the coast at a water depth of 2,850 m, making it one of the deepest subsea projects in Africa. Phase 1, currently under development, will export gas to a floating production storage and offloading unit (FPSO) located approximately 40 km offshore, where gas will be processed and liquids separated before being exported to floating LNG facilities situated 10 km offshore. It is expected to produce around 2.3 mn tons of LNG per year once operations commence.

Phase 2 will accelerate the economic development of both Mauritania and Senegal, positioning the two nations as major oil and gas producers.

NEWS ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 9

Angola: From discovery to Africa's leading oil producer.

Phase 2 will accelerate the economic development of both Mauritania and Senegal, positioning the two nations as major oil and gas producers.

Image Credit: Energy Capital & Power

Image Credit: Energy Capital & Power

BOOMING LNG MARKET FOR HOME AND ABROAD

NO SOONER DID Europe declare sanctions on Russian gas than African nations felt they struck gold. The countries were as if on a race to tap the vast European gas market, with Egypt out in front. The North African country has been harnessing natural gas long before it gained popularity as a comparatively sustainable alternative to fossil fuels. The 14,400 MW Egypt Megaproject by Siemens Energy, Elsewedy Electric and Orascom Construction deliver power to more than 40mn Egyptians. It includes three combined-cycle power plants in Beni Suef, Burullus, and New Capital that are considered some of the world’s largest.

According to Bimbola Kolawole, vice president and head of business development for Africa, Rystad Energy, following the eastern Europe conflict, Europe's reliance on LNG imports has grown and African LNG producers, led by Nigeria, Egypt, and Algeria stand to benefit.

A report by the African Energy Chamber titled the State of African Energy 2023 Q1 Report states that Algeria and Egypt likely will maintain their existing LNG infrastructure capacity of about 29mn tonnes per year and 12.7mn tonnes per year respectively.

Egypt’s latest addition to a flurry of LNG projects since last year is a US$1.8bn gas deal. The country’s Minister of Petroleum and Mineral Resources, Tarek El Molla, confirmed to media early this month that the programme will kickstart drilling natural gas exploration wells in the Mediterranean Sea and Nile Delta. It is a heavyweight project backed by the likes of Eni, Chevron, ExxonMobil, Shell and BP.

Sharing the project’s plans, El Molla said

African LNG producers, led by Nigeria, Egypt, and Algeria, stand to benefit from Europe’s LNG needs.”

Egypt to kickstart drilling natural gas exploration wells in the Mediterranean Sea and Nile Delta under a US$1.8bn deal.

EGYPT ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 10

Image Credit: Adobe Stock

Egypt to kickstart a heavyweight LNG project backed by several majors.

that around 35 exploration wells are slated to be drilled within two years; 21 in the current 2023-24 financial year and 14 in the following year.

Last month, in an instance of bilateral cooperation, Egypt entered into an agreement with Jordan to mutually share natural gas. Under the agreement, the Jordanian government will open the port of Al-Ahmad AlJaber Al-Sabah in Aqaba City to Egypt and let it utilise a floating storage regasification unit (FSRU) situated there. Egypt, on the other hand, can provide strong backing to the Jordanian National Electricity Company in terms of meeting sudden LNG requirements. It will help bring down operational costs of the port as well. The agreement will be valid till 2025.

As a part of the Middle East and North Africa (MENA) region, which makes up about 60% of the world’s oil reserves and 45% of its natural gas reserves, the strategic position of Egypt cannot be ignored. In June, Israel and Egypt signed a deal with the European Union (EU) to supply Israeli gas via Egypt’s LNG plants to the EU.

Egypt can be called the venous system that keeps alive the economy of the region. In May, partners in the Aphrodite natural gas field offshore Cyprus, revised their approach and decided to build a subsea pipeline that will connect the field to an existing processing and production facility in Egypt.

According to an estimate made by the operator Chevron, the updated development plan is expected to reduce the costs compared to the original plan, and bring forward commencement of production of the natural gas from the reservoir.

El Molla acknowledges the EU as one of the most prominent partners of the Egyptian energy sector, which has always had an important and active role in various oil and gas activities in Egypt. He pointed out that since the 2018 signing of a memorandum of understanding (MoU) for strategic cooperation in the field of energy between Egypt and the EU, both the sides enjoy a fruitful long-term relationship and the EU has become Egypt's largest trading partner.

“The geopolitical tensions and energy market fluctuations that the world is currently witnessing are motivating countries to further diversify their energy sources in order to achieve energy security. Energy security and

energy neutrality are complementary goals and that Egypt's vision is to play a key role in the flow of global energy trade and promote a Better Business Link environment to ensure continued cooperation. Egypt has proved that it holds the keys to being a regional hub for gas and oil through its strategic location, a well-established energy industry and a strong infrastructure that helps to monetise all the potentials in the eastern Mediterranean region,” El Molla said.

While targeting the European market on one hand, Egypt is also mindful enough to safeguard its domestic needs on the other. The only way the international oil companies and independents can become involved in Egypt’s upstream sector is through a joint venture company with a state-owned entity such as the Egyptian General Petroleum Corporation (EGPC). While the contractual agreements take different forms — production sharing being the most common — the approach enables Cairo to keep close tabs on its resources (and ensure appropriate extraction) while granting its partners access to opportunity accompanied by reduced risk. Today, no fewer than 50 IOCs and independents are joint venture participants, and they are having a huge impact on the country’s economic well-being. According to the International Trade Association, hydrocarbon production is ‘by far the largest single industrial activity in the country’. In fiscal year 2019-2020, with oil output fairly stable, it represented approximately 24% of total GDP.

Such well-structured practices to support the North African nation’s vast resources no doubt opens doors to lucrative investment prospects.

EGYPT ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 11

Egypt's vision is to play a key role in the flow of global energy trade.

Image Credit: Adobe Stock

Egypt likely will maintain its existing LNG infrastructure capacity of about 12.7mn tonnes per year.

Image Credit: Adobe Stock

CAN LIBYA ACHIEVE ITS HYDROCARBON POTENTIAL?

LIBYA, A COUNTRY

roughly the size of Mexico, is among the world’s few ‘under-explored’ provinces with excellent potential for more oil and gas discoveries. To date, only one quarter of its vast territory has been explored for hydrocarbons. The International Energy Agency (IEA) reckons ‘fully explored’ Libya could yield a further 100bn barrels of oil equivalent – hence it could be a magnet for foreign energy majors given a stable political/security environment.

Libya’s proved oil and natural gas reserves at 48.4bn barrels and 53 trillion cubic feet (Tcf) respectively as of end-2020, are based on outdated analysis by Libyan National Oil Corp; (NOC), various consultancies and international oil companies (IOCs), notably Eni, Royal Dutch Shell, and the US ‘Oasis Group’ –ConocoPhillips, Hess, and Marathon. Thus, significant future reserves upgrade is a realistic probability. NOC estimates ‘ultimate recoverable reserves’ at 144bn barrels and 100 Tcf, respectively, on massive exploration and development, aided by IOCs’ sophisticated technologies. UK-based Bayphase energy consultants put Libya’s proved plus probable potential remaining reserves at 67bn barrels and 89 Tcf.

Geology

There are six sedimentary basins in Libya, four of which have proven petroleum systems. These

are Sirte, Murzuq, Ghadames, Pelagian, Cyrenaica, and Kufra. The prolific Sirte basin is well explored compared to others with three geological trends: western Fairway; north-centre region; and the eastern trend housing the giant Sarir field with 8bn barrels of recoverable reserves. The Murzuq basin in the Sahara Desert boasts probable reserves of 25bn barrels. More than 90% of recoverable reserves are in the onshore Sirte and Marzuq basins – they also account for the bulk of oil production capacity.

The partially developed Ghadames basin (an extension of Algeria’s Berkine basin) boasts exploration potential in

Devonian, Silurian, and Triassic reservoirs. The mainly unexplored Kufra basin near Chadian and Sudanese borders may contain 4bn barrels of oil. The frontier offshore Cyrenaica and Pelagian basins along the western and eastern coasts also possess considerable potential. The northern part of the Gulf of Gabes holds possibilities of 3.7bn barrels and 12 Tcf of natural gas in the area. According to IEA, the ‘oil-belt’ regions of Libya could possess 220bn barrels of originaloil-in-place.

Upstream attractions

Libya can become the ‘hot spot’ for IOCs’ search for new fossil

fuel supplies thanks to superior reserves of light (high API gravity) and low-sulphur (sweet) crude requiring little refinement (unlike sour crude) and cheap cost of oil recovery. Its production capabilities resemble those of mid-east Gulf rather than African producers. The bulk of oil reserves are deposited in 21 giant fields, chiefly Sarir, Sharara and Deffa-Waha.

Closer proximity to important European refining centres on the Mediterranean means lower transportation costs compared to Persian Gulf and sub-Saharan African producers. Main export blends (Es Sider and Sharara) fetch higher premiums on global

Moin Siddiqi, economist, examines whether Libya can regain its status as a prominent oil exporter.

LIBYA ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 12

Significant future reserves upgrade is a realistic probability for Libya’s oil and gas.

Image Credit: Adobe Stock

markets for gasoline and middle distillate yields. The desert area is yet to be explored using sophisticated technologies of IOCs.

What is undeniable is Libya’s ‘natural prospectivity’ to dramatically expand oil and gas production over the next decade, thus making it Europe’s vital energy supplier. Libya in 1970 was producing 3.3mn bpd from just a dozen oilfields.

A plethora of challenges

Libya, despite its plus factors, has been plagued since 2011 by chronic problems that prevented a large-scale exploration programme, foreign direct investment (FDI) and sustainable output increases, as well as nation building. These include infrastructure bottlenecks, years of reservoir mismanagement, severe under-investment, NOC’s budget constraints, political dissention (civil strife), shortages of skilled manpower, rigs/equipment, and labyrinthine bureaucracy (red tape), as well as militia blockades of several western fields and ports that pushed oil output below 0.5mn bpd few years ago.

The annual ‘natural’ decline rate is estimated at 10% or higher – with reserve replacement also slipping over three decades. Therefore, the main challenges are to re-develop ageing fields such as block NC-174 in the Murzuq basin and finding/developing new oil-gas fields including in the Ain Jarbi block, while maintain rising production trajectory.

Harnessing gas resources

Gas exploitation is in its infancy, although proved reserves (53 Tcf) rank as the world’s 16th highest, with output averaging only 13bn cubic metres (cu/m) per annum over 2012-21 (BP data). Offshore gas is known to exist in large quantities, but associated gas has been flared off for decades. There is potential to monetise gas reserves as

feedstock for electricity, and expand existing piped and liquefied natural gas (LNG) exports. Last year, Libya exported a modest 3.2bn (cu/m) of natural gas to Italy (Sicily) via the 32-inch, 595-km underwater pipeline GreenStream. Libya aims to maintain gas output at least 1.5bn cubic feet/day (bcf/d).

Last February, Eni became the first major to announce a new project in Libya in over two decades. It signed an US$8bn agreement with the NOC to produce about 850mn cf/d by tapping estimated reserves of six Tcf from two offshore gasfields. NOC commented the Eni deal is “just the first step in a long way for more and more investment.” NOC has pledged to boost gas output by reducing flaring and developing new non-associated fields.

The exploration and development of offshore acreage for discovering prospective gasfields in the Mediterranean Sea is expected to provide a significant growth opportunity for IOCs.

Signs of recovery

The country’s gross domestic product (GDP) closely tracks the petroleum sector. The underutilised oil and gas industry is the engine of future growth.

While there has been exceptional swings in Libyan oil output and exports, the end-2023 production goal is 1.6mn bpd, according to Oil & Gas Minister, Mohamed Aoun. But total output still lags the pre-conflict era (1.82mn bpd in 2008).

Libya is prioritising a key US$3bn offshore expansion project led by Eni and NOC to help reach near-term goals, while shifting some oil capabilities from the onshore to the offshore arena. That, in turn, can increase oil reserves and counter factionbacking militias with power to disturb production.

The giant Waha oil concession in the Sirte basin – a joint venture between TotalEnergies,

ConocoPhillips, and the NOC –boasts capacity to produce 350,000 bpd altogether. Eni and BP plan offshore drilling in the Ghadames and Sirte basins next year.

The Tripoli-based Government of National Accord (GNA) intents to comply with global benchmarks in order to enhance the export potential and attract greater FDI. Last February, NOC unveiled a new plan ‘Strategic Programmes Office’ (SPO), in collaboration with U.S. firm KBR to help “improve fiscal transparency and keep pace with developments in the oil sector worldwide.” The strategy aims to raise sustainable productive capacity to 2mn bpd in three to five years, from around 1.2mn bpd presently –contingent on increased exploration and development to ensure the longevity of the sector.

Under the plan, new oil/gas blocks will be offered for exploration for the first time since 2006. Last May, Eni, TotalEnergies, and ADNOC began negotiations on the potential exploration and development of oil/gas fields in NC7 block in the Ghadames Basin (where new finds are reported). Iliasse Sdiqui, associate director at Whispering Bell, a risk management firm covering North Africa, explained, “The idea is that to draw foreign investment you need to be more transparent, and you need to enable IOCs to take a look at your books.” Sdiqui added, “This strategic programme office is (set up) both to enable IOCs to be comfortable with channelling money into the east, and also to satisfy the local communities in the region.”

Regaining its former status

Several changes are crucial to develop Libya’s energy industry to its full potential.

Prospects for sustained gains in oil recovery and production depend on several variables.

These include huge FDI bringing it up to scratch with Gulf producers, enhanced oil recovery (EOR) and improved oil recovery (IOR) techniques, rehabilitation of damaged fields, horizontal and deep drillings, production/pressure maintenance technology and stream injecting, bolstering power supplies to oilfields, efficient reservoir management, new favourable contract terms for IOCs, pipeline expansion for exports, and improved training and safety procedures for workers in oil operations, as well as upgrading institutional capacity within the NOC.

NOC hopes to mitigate ongoing depletion of matured oilfields, notably Deffa and Sarir though EOR techniques that could hike capacity by 775,000 bpd and unlock probable reserves, especially in the frontier basins of Cyrenaica and Kufra.

There is a realistic possibility of Libya achieving much higher production, assuming adequate investments and national security. Bayphase consultants estimated that at least US$4681bn is needed over the longer term to fix Libya’s decrepit infrastructures and upgrade the capacities of upstream (production facilities); midstream (pipelines, terminals); and downstream (refineries, gas processing plants) sectors.

In sum, Libya’s revival would also help improve Europe’s energy security with an impact on global oil supply. There is appetite among IOCs for ‘untapped’ upstream opportunities, but civil stability is pivotal for optimal development of Libya’s energy sector.

LIBYA ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 13

Libya can become the hot spot for IOCs’ search for new fossil fuel supplies.”

LOOKING TOWARDS NEW OPPORTUNITIES

LIBYA HAS MANAGED to pull a significant turnaround of its energy sector following a prolonged period of difficult political turmoils. As of the end of February, crude oil production was near to pre-blockade levels at 1.164 mn barrels of oil per day (bopd).

The North African country’s gas production amounted to 3.178 bn cu/m during the first quarter of 2023. Libya’s Minister of Oil and Gas, Mohamed Aoun, is positive that the country is capable of producing 1.4 and 1.5 mn bpd oil in 2024, and is right on track to hitting the 2 mn bopd mark set by the National Oil Corporation for 2023-27.

According to the International Monetary Fund, the country expects production to increase by a further 15% this year, opening new opportunities for revenue generation and economic growth.

Libya is now on a path towards increased investment and development in the energy sector. In recent media interviews, Aoun informed that the NOC is in talks with the Italian company, Eni, to develop the Hamada gas fields. Eni described the US$8bn deal as a ‘strategic project aimed at increasing gas production to supply the Libyan domestic market as well as to ensure export to Europe’. Targeted to come onstream 2026, the project has two structures with a combined gas production of up to 750

million standard cubic feet of gas per day.

“Libya exports gas to Italy, but not in the quantity that meets the demand for in Italy and Europe, although gas

discoveries in Libya can achieve this demand, but after working on developing the discovered fields and starting work on them,” Aoun had said earlier.

Other recent developments in the Libyan oil and gas industry include the signing of a front-end engineering designing agreement with USA’s Honeywell UOP for its South Refinery.

“The refinery will start operating in the south within 36 months,” NOC chair and chief executive, Farhat Bengdara, said. “Through our contract with

Honeywell UOP, we seek to increase the production capacities of the refineries in Zawia, and to find suitable and available solutions for the Ras Lanuf refinery.”

Libya has also witnessed an oil discovery on Block 4 of the Ghadames basin. Commenting on the third discovery in Contract Area 82, the NOC stated, “The achieved flow rate is 1,870 bopd from Devonian and Ordovician sandstones by certain choke size according to the Libyan legislation.”

REFINERIES ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 15

Crude oil production of Libya was near to pre-blockade levels since February.”

Libya’s South Refinery, that recently witnessed the signing of a feed agreement, will start production soon.

Libya is now on a path towards increased investment and development in the energy sector.

Image Credit: Adobe Stock

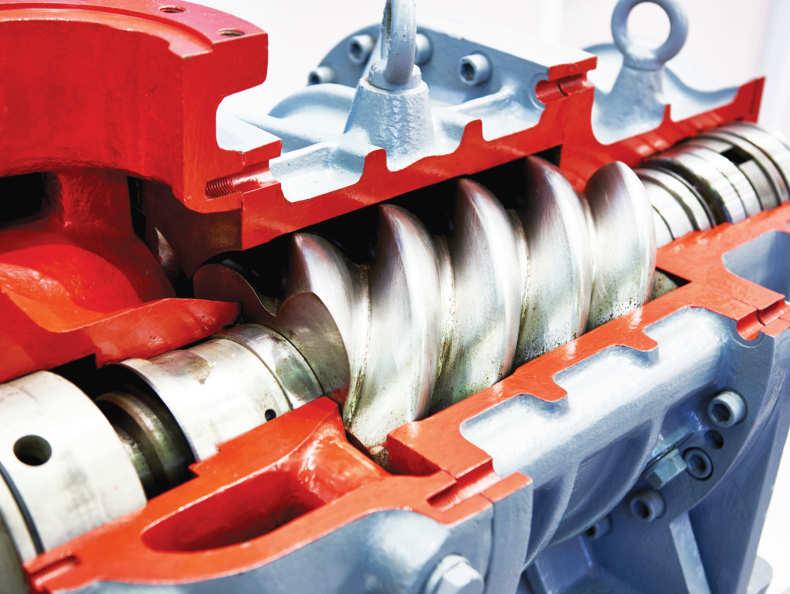

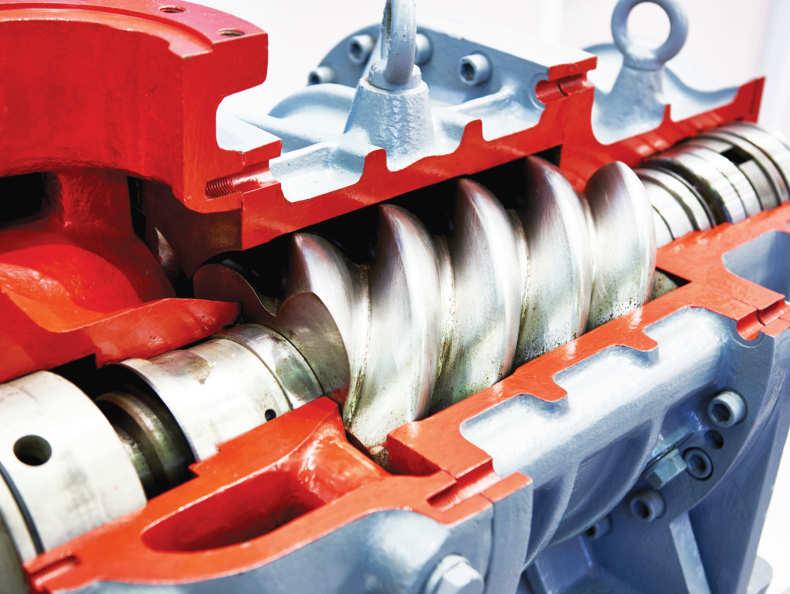

IMPACT OF CHANGING FIELD CONDITIONS ON FLOW MEASUREMENT

Chris Mills, senior consultant engineer at TUV SUD National Engineering Laboratory, highlights techniques that would help the oil and gas industry to efficiently tackle flow management issues within mature fields.

FLOW MEASUREMENT IS a vital aspect of hydrocarbon production. Understanding, monitoring and controlling flow rate, as part of key processes, are essential elements to the viable operation of production systems across the world.

It provides the means for well testing, process monitoring and production optimisation. Flow metres are also used as the basis for fiscal and custody transfer measurement of hydrocarbons. In this sense, they can be thought of as the ‘cash registers’ of the industry. Accuracy in such applications is paramount and even small measurement errors over the course of a year can amount to significant loss in revenue.

Flow metres, like most types of process equipment have fundamental performance limitations making them susceptible to changing field conditions that occur as a reservoir matures. Over time, reservoirs that once produced high volumes of almost exclusively hydrocarbon can gradually transition to a state where they produce low volumes of almost exclusively water. These large shifts in production rates and composition impose a heavy burden on production equipment which typically have a limited operating envelope and are increasingly pushed to perform under conditions they were not

originally designed for. This impacts flow measurement in a number of ways. One of the most significant impacts comes from the diminished hydrocarbon production rate forcing metres to operate below their operating or calibrated range. The range over which a flow metre can effectively operate, known as ‘Turndown’, is the ratio of the maximum to minimum flow rate over which the flow metre can perform. This is sometimes also

referred to as ‘flow range’ or ‘rangeability’. Different types of flow metres typically have different ‘Turndown’ ranges depending upon their fundamental principle of operation.

Considering the turbine flow metre as an example, these metres if implemented correctly, can be extremely accurate and repeatable, and are frequently used in fiscal applications where accuracy is vital. However, like most flow metres, they have a

Turbine flow metres can be extremely accurate and repeatable, and are frequently used in fiscal applications where accuracy is vital.”

FLOW MANAGEMENT ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 16

Image Credit: Adobe Stock

Accuracy in flow metres is of paramount importance.

‘Turndown’ and care must be taken in selecting the correct metre or number of metres for a given application. Since the flow metre returns a pulse signal which is proportional to the flow rate, the metre is calibrated in terms of the number of pulses per unit volume (K-Factor) of fluid which flows through the metre. Intuitively, one might expect that the relationship between KFactor and flow rate should be linear. However, in reality, that is not the case. The mechanics of the metre means that there is a limited range of which this linear relationship is true. Outside these ranges, the behaviour of the metre becomes significantly nonlinear and more complex, generally resulting in lower accuracy. Flow metres are typically calibrated over this linear and ‘predictable’ flow range.

All metres exhibit this limitation in one way or another. However, depending upon the principle of operation, some metres have wider turndown than others. Differential pressure metres for instance, such as orifice plates or Venturis, have historically had a small turndown of around 4:1 (although now improved with newer differential pressure transmitter technology), whereas some modern types such as ultrasonic metres can operate at turndown ranges of 200:1 or higher. As reservoirs mature,

dropping hydrocarbon rates typically force metres to operate at the bottom of their operating range, if not below, whereas on the opposite side, produced or wastewater flow metres tend to operate at the high end of their operating range. In some cases, it is possible to characterise the behaviour of a device below its defined operating range and thereby extend its capability - so long as the behaviour of the device does not become significantly non-linear. In other cases, the only solution will be to either replace the flow metre or redesign the flow measurement system.

To provide confidence that the measurement taken by the device remains accurate, the device should demonstrate traceability to a higher-level standard. This occurs through

applications however, it is the user who must define the calibration methodology and flow conditions. If the field conditions have changed, then the calibration temperature, pressure, fluid viscosity and flow

there are several other problems that can arise from changing field conditions. These include material erosion caused by increased sand loading, distorted, swirling or asymmetric flow profiles caused by upstream process equipment or pipework resulting from system modifications, or changes in fluid physical properties to name just a few. All of these factors must be monitored as they can have a detrimental effect on metre performance.

flow calibration at a traceable and accredited flow laboratory or onsite prover system if space, weight and financial constraints allow. Specific industry standards or agreements normally dictate the calibration frequency. For most

range should be amended to match the service conditions.

In addition to the operating range of the metre, another significant factor is phase contamination. As separation systems are pushed to operate at the extremes of their performance envelope, phase contamination becomes a serious risk, resulting in a mismeasurement of the hydrocarbon produced.

Electromagnetic water metres, for instance, are affected by the presence of oil since oil is not conductive, and transit-time ultrasonic metres are seriously affected by the presence of a secondary phase. Great care must be taken in understanding the performance limitations of the metre and the conditions in which it operates. Moreover,

Since every application is unique, the solution to this problem is not always straightforward. All factors should be considered before selecting a course of action. Regardless of the measurement technology used, a key consideration is to understand the measurement uncertainty and calibration requirements for the application. In addition, performance, calibration frequency, recognition of these points in the quality system and accuracy requirements should be considered along with reviewing other relevant technical factors such as fluid properties, ideal turndown, contamination, and operating conditions. Economic and human factors should further be considered. Finally, manufacturers and regulators should be consulted, and appropriate standards observed.

ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 17

To provide confidence that the measurement taken by the device remains accurate, the device should demonstrate traceability to a higher-level standard.”

Turbine flow metre calibration.

Image Credit: TUV SUD National Engineering Laboratory

Image Credit: TUV SUD National Engineering Laboratory

FLOW MANAGEMENT

Turbine metre render.

ASSET INTEGRITY IS an integral part of all industries; the energy sector can crumble from the absence of proper asset integrity management. “While asset integrity may not be a topic of frequent discussion, except in the context of catastrophic failures, it plays an essential role in guaranteeing the safety and reliability of energy supply and the well-being of personnel. Effective management of asset integrity can contribute to reducing potential risks, optimising productivity, minimising downtime, and meeting operational and safety requirements,” said Romin Matthew, director, Aldrich International, at the recently held Middle East Asset Integrity Management Conference and Showcase in Abu Dhabi.

Luanda-based service provider, Prometim, specialises in maintenance, asset integrity and EPC activities in the energy sector and wider industry. Its reach extends from Angola, Congo and Mozambique in Africa through to the UAE in the Arabian Gulf and Portugal in western Europe. Global controls technology company, Proserv, recently announced that it has established an arrangement with Prometim, whereby the Angolan business will act as its local representative in both Angola and the Republic of Congo.

The tie-up will see the two companies leverage Proserv’s

OPTIMISING PRODUCTIVITY, MINIMISING RISK

worldwide footprint and expertise in control system integration to pinpoint opportunities in the region’s mature deep water subsea oil and gas activities. Angola has one of the largest numbers of subsea control modules (SCM) installed

globally with around 600 SCMs currently deployed. Proserv and Prometim aim to harness the former’s reputation for optimising ageing, unsupported and obsolete controls infrastructure to extend the life, and enhance the operational performance, of these brownfield assets.

It is also anticipated that the two parties can target multiple topside controls openings and upgrades via floating production, storage and offloading units (FPSO) as well as conductor support platforms in shallower waters. It is expected that Proserv’s broad portfolio of offerings including its award-winning service operation as well as its measurement and sampling teams

can look to further develop their footprint in west Africa as a result of this agreement.

“It is our mission at Prometim to deliver high quality levels of service for our customers to make a real difference to their competitiveness and performance. Our stated goal is to add value to their operations. By cementing this arrangement with Proserv, we can take this aim to another level. Proserv offers innovative and impactful solutions, both subsea and topside, that have life extension and optimisation at their core. We are very happy to represent such a global market leader,” said Paula Dantas, Prometim’s managing director.

ASSET INTEGRITY MANAGEMENT ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 18

Proserv and Prometim aim to extend longevity and enhance performance of brownfield assets in Angola.”

Asset integrity services provider, Prometim, to leverage Proserv’s worldwide footprint and expertise in control system integration to pinpoint opportunities in Angola and the Republic of Congo.

Proserv and Prometim can target multiple topside controls openings and upgrades.

Image Credit: Proserv

RETHINKING EXPORT ROUTES

SOUTH SUDAN’S OIL production might witness a disruption owing to the Sudan conflict. The oil of South Sudan is reliant on two pipelines, both of which run through Sudan and converge at Khartoum ‘where the fighting is heaviest’, said Hope Finegold, Dryad Global analyst, to media.

“Oil flow to terminals will likely be impacted and exports are expected to be reduced due to supply disruptions,” he said.

With the conflict adversely impacting the region’s export plans and oil prices as well, the government is seeking alternative export routes as back up. It is planning to construct the road from the Bentiu oil refinery in the north to Gogrial in the west to transport refined oil and make space for storage. The refinery may also be revived to accommodate greater storage capacity.

Located in Unity State, Bentiu’s output has since come online –pumping anywhere from 3,000-10,000 barrels per day and exporting products to neighbouring Sudan – with the Group currently looking to expand regional distribution.

Speaking about the Bentiu Refinery last month at the South Sudan Oil & Power (SSOP)2023 conference, David Galla, vice president of SNP Group, said, “[The refinery] is operational and in good shape. We have been providing products to Sudan. With the current situation in our neighboring country, we are looking to the East African region. We have already been contacted by a number of companies in the region, as well as the Congo,” said David Galla, Vice President of SNP Group (a joint venture between South Sudan’s Nile Petroleum Corporation and Russia’s Safinat) at South Sudan Oil & Power (SSOP)2023. “By August or September, the product will be ready to be shipped across the region.”

Advancements on the Bentiu Refinery would be significant for South Sudan, who despite having the third-largest oil reserves in sub-Saharan Africa, has suffered from limited refining capacity to date and imports the majority of its local refined oil demand. The viability of these plans is supported by the high quality of production from the refinery, of which ‘70% has close to zero sulfur content. This is very rare,’ noted Galla.

Putting aside the conflict situation, South Sudan boasts 3.5 bn barrels of proven oil reserves, and more than 70% of the market remains untapped. Despite the region’s status as a producing market, the government has placed new focus on expanding exploration and production with the aim of mitigating natural declines in legacy fields, bolstering energy security efforts while attracting a new slate of investment into the promising market.

SOUTH SUDAN ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 19

Government to expand the storage capacity of Bentiu oil refinery.”

South Sudan is focusing on expanding exploration and production with the aim of bolstering energy security efforts.

Advancements on the Bentiu Refinery would be significant for South Sudan.

Image

Credit: Adobe Stock

ACHIEVING PERFECT COMPATIBILITY

ChampionX successfully delivers an environmentally improved scale treatment solution that is also qualified for umbilical line usage for an offshore project in Angola.

AS THE OIL and gas industry continues efforts to increase recovery from existing fields, operators are working harder to maintain flow assurance.

Scale build-up is common, causing significant pipeline blockages impacting production and reducing economic recovery from the field. Traditional methods to alleviate the issue include mechanical pigs and jetting, however as the industry encounters more challenging scaling environments, chemical scale inhibitors are increasingly being used.

During a project offshore Angola, barite and calcite scales were detected in separate flowlines, as well as calcite in the hydrocyclones on an FPSO vessel. Due to changes in the Angolan environmental regulatory framework, an environmentally improved scale treatment solution also qualified for umbilical line usage was required.

The presence of F22 lowalloy steel within the well completion represented a further challenge; the required scale inhibitor had to be effective, benign to the construction materials and compatible with the process fluids.

ChampionX, a global leader in chemistry solutions and highly engineered equipment and technologies that help companies drill for and produce oil and gas safely and efficiently, was tasked to develop, test and select the optimal chemical solution to meet all the required specifications.

Scale inhibitor evaluation

Initially, several scale inhibitor chemistries were examined by dynamic scale loop (DSL) testing. However, none achieved the required scale inhibition performance on their own. It was then decided to evaluate blends of scale inhibitors to assess whether a synergy between two different chemistries could offer improved inhibition performance while still having low corrosivity toward F22 metallurgy, being fit for application via umbilical and meeting the Angolan environmental guidelines.

The chemistries selected for testing were known to have lower corrosivity toward metals. One used a polymer which had previously been applied successfully with F22 alloy and another used a polymer widely deployed in the North Sea in cases where low corrosivity is required along with strict environmental properties.

Since many traditional scale inhibitors are known to be

corrosive against low-alloy steels, several additive chemistries were incorporated to further reduce the corrosivity of the blend. These final blends were successful in meeting the scale inhibition performance target and were found to offer good compatibility with F22 alloy under application conditions.

Since the product would be applied through an umbilical, sufficient concentration of dispersants and surfactants were added to make stable formulations. Each candidate chemistry was rigorously tested for thermal stability, highpressure viscosity, cold stress, hydrate resistance and particle count to understand the feasibility of application via umbilical.

Experimental methods

Once the blended scale inhibitors were selected, a comprehensive testing programme was carried out, which included materials compatibility, static thermal

Each candidate chemistry was rigorously tested to understand the feasibility of application via umbilical.”

SCALE INHIBITION ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 20

An innovative scale management programme offshore Angola allowed compatiblity with low-alloy steel.

Image Credit: ChampionX

stability, brine compatibility and viscosity testing. The water compositions used for testing were specified by the operator and closely matched the produced water composition of the field.

Materials compatibility testing was also done to determine if the selected scale inhibitor was likely to pose a threat to the integrity of the materials of construction. To understand the corrosivity trends, each individual component of the selected chemistries was first evaluated for materials compatibility in a three-day static test at 120°C. Based on those results, different formulations were ranked and final corrosivity tests with the top candidates were conducted for 28 days.

For brine compatibility testing, the scale inhibitors and brines were mixed at varying concentrations, including 0 ppm, 1000 ppm, and 1%, 10%, 25%, 50%, 75% and 90% chemical in brine. The solutions were then shaken and placed into an oven to be heated to 110°C for the evaluation period. They were observed at 0, 2, 4 and 24 hours

for precipitation, changes in clarity or phase separation.

While an area of incompatibility was seen, initially comprising haze formation immediately after mixing at 10% and increasing to form precipitation between 1% and 75% after 24 hours, one of the proprietary scale inhibitor blends was fully compatible at the lower concentrations recommended for application over the time periods the chemical was likely to be present at application concentration.

Dynamic compatibility testing aims to replicate the application

of scale inhibitor from neat chemical to the laboratorydetermined minimum inhibitor concentration (MIC), which would determine the ideal application concentration. This testing was performed by injecting the scale inhibitors into the brine at the application concentration as shown in Figure 2 [Dynamic compatibility testing in brine at 90°C (mid-injection)]. The samples were then heated to field temperatures, and the injection point was observed for any haze, precipitation, or gel formation. No changes were observed at any point during or after injection, indicating full compatibility with the brine at the tested temperature.

Static jar testing assesses scale inhibitor performance as crystal growth modifiers against barium sulfate and is an industrystandard method. For static jar testing, powder jars were prepared with anion brine. The candidate scale inhibitors were then dosed into these jars at the appropriate volume for the required concentrations. In addition, a blank sample of anion brine with no scale inhibitor

present, and a control jar, were prepared with sulfate-free brine to replace the anion solution.

Conclusion

All the testing performed by ChampionX detailed the process whereby different additives were evaluated with scale inhibitors to develop a solution which provided an acceptable general, as well as localised, corrosion rate against F22 low-alloy steel.

The final candidate formulation was compatible with the brine at the concentrations and time periods likely to be experienced in the field. It was subsequently effective against a mixed barium sulfate and calcium carbonate scaling regime.

Several conventional and widely applied scale inhibitor formulations were evaluated against the brine chemistry provided and were found to have higher MICs than the proprietary blend of the same scale inhibitors tested via DSL. There, the lowest MIC was determined to be 15ppm, versus 20-30ppm for the scale inhibitors evaluated on their own. The results of DSL testing suggest a degree of synergistic effect was seen.

However, static jar testing indicated a similar level of performance between the different test chemistries against a purely barium sulfate scaling regime, indicating the synergistic effect may not be applicable to all scale types.

Materials compatibility help understand corrosivity trends in a three-day static test at 120°C.

Image Credit: Adobe Stock

Materials compatibility help understand corrosivity trends in a three-day static test at 120°C.

Image Credit: Adobe Stock

SCALE INHIBITION ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 21

Materials compatibility testing determined if the scale inhibitor was likely to pose a threat to the integrity of the materials of construction.”

Dynamic compatibility testing in brine at 90°C (mid-injection).

Image Credit: ChampionX

AS AFRICA’S ENERGY sector matures, so does the demand for safety clothing and personal protective equipment (PPE) across the continent. Some aspects of the oil and gas sector are inherently dangerous, a point borne out by higher average fatality rates for workers compared to other industries.

Common hazards from fires and falls to handling chemicals or working with high-powered machinery. It means the list of materials required on any given installation is long, covering the likes of flame-resistant suits and breathing apparatus to heavyduty boots and hard hats.

Major players producing PPE for the oil and gas sector and other markets include the likes of 3M, Portwest, Moldex, Ergodyne and Dräger.

New technology is also helping to improve safety standards for workers, refreshing even the most basic kit. A report by McKinsey & Co. notes how PPE now extends beyond the basics to state-of-the-art gear, such as clothing with sensors that monitor body temperature and thermoplastic-coated protective gloves that are strong yet

SAFETY FIRST

flexible. It says fabrics used to make safety clothing are improving because of research into materials such as polyolefins, polyamides and ultrahighmolecular-weight polyurethane.

For safety glasses, for example, foam linings and antifog coatings provide better visibility and are more comfortable to wear, boosting end-user acceptance and sales.

An ‘intelligent’ kit set-up also provides further assurances for workers, connecting them via remote sensors, to colleagues monitoring hazards far away from the immediate danger.

But these advances inevitably inflate price, which may be more bearable in affluent markets, but could cause stress potentially in work sites in developing regions such as Africa.

Durability is one of the core requirements, however, which means that investing in highquality typically pays dividends in terms of both economics and worker safety.

The anticipated growth of the oil and gas industry in the coming decade, and other heavyuse sectors such as mining, is likely to drive overall PPE sales.

McKinsey also noted in its 2021 report a greater emphasis generally on worker safety among industry which, again, is likely to boost the market for safety clothing.

Oil and gas companies are also exploring ways to navigate cost and supply pressures for PPE. Some suppliers have reported an upward trend in rental sales, not only to manage costs, but also because of

pressure on supplies and long lead times during times of heightened demand.

Dräger Marine & Offshore, a subsidiary of Dräger, has seen an increase of more than 20% in the rental of equipment from its new sales hub in Aberdeen.

Dräger’s Matthew Bedford called it an indication of the way the general market is going. “Supply issues across all industries have meant customers can’t get the equipment they need as easily as they once could. Manufacturer lead times across the globe can be up to six months, but by hiring equipment such as gas detectors and breathing apparatus, customers can receive what they need sooner, sometimes within hours of placing an order.”

Oil and gas companies are also exploring ways to navigate cost and supply pressures for PPE.”

New smart technology and flexible rental terms are reshaping the market for personal protective equipment and safety clothing in an industry known for its hazards, writes Martin Clark.

SAFETY CLOTHING ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 22

The growth of the oil and gas industry, along with mining, is likely to drive overall PPE sales.

Image Credit: Adobe Stock

PRACTISING SELF SUFFICIENCY TO ACHIEVE JUST TRANSITION

WITH MAJOR INTERNATIONAL companies walking out of projects, the African oil and gas industry has been left high and dry. One of the hardest hit among several initiatives is the 1,443km insulated East African Crude Oil Pipeline (EACOP) that was deserted by as many as two dozen lenders, with Standard Chartered Bank joining the long list last May.

EACOP is still breathing owing to the support of a few

banks such as South Africa’s Standard Bank, Sumitomo Mitsui Banking Corporation and Mitsubishi UFJ Financial Group (MUFG), both of Japan, and Industrial and Commercial Bank of China (ICBC).

While investors considering

oil projects like EACOP are facing a severe backlash from climate enthusiasts, things are not that smooth for natural gas initiatives either, although it is being sought as the cleaner alternative to crude. According to France’s Société Générale, it is

difficult to ignore the growing importance of environmental, social and governance (ESG) with an increasing number of buyers developing specifications for green (carbon neutral) LNG in their purchasing policies and the financing markets could further shift capital towards those who will embrace such specifications. ESG matters are increasingly influential in shifting capital flows.

The LNG industry, however, has been creative in project

Development finance institutions and multilateral development banks are coming forward to support energy projects.”

The African Energy Transition Bank addresses an urgent and existential need on the continent.

PROJECT FINANCE ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 24

The African Energy Transition Bank has a specific remit to raise funding for oil and gas projects.

Image Credit: Adobe Stock

structuring. Equally, innovation and new technologies should provide it with greater insulation from ESG-related pressures.

TotalEnergies’ Mozambique liquid natural gas (LNG) project is subjected to a US$4.7bn loan agreement review from the US Export-Import Bank (US Eximbank) before it can be restarted. The financial institution will look into possible risk factors and make sure that the project is in tune with ESG standards.

While global investors are withdrawing from the African oil and gas space, there is still a sunnyside to it. The vacuum is being filled by development finance institutions (DFIs) and multilateral development banks (MDBs) from within the continent.

In May 2022, with an aim to support energy transition strategies in Africa, the African Export-Import Bank (Afreximbank) and the African Petroleum Producers’ Organisation signed a memorandum of understanding to establish the African Energy Transition Bank, with a specific remit to raise funding for oil and gas projects.

The institution is set to accelerate Africa’s economic development, whilst ensuring this progress is compatible with, and complementary to, the sustainable development goals (SDG) as well as the continent’s long-term social and environmental objectives as set out in African Union’s Agenda 2063: The Africa We Want.

The African Energy Transition Bank addresses an urgent and existential need on the continent. Africa stands to experience profound effects from climate change, while the considerable poverty across the continent further disincentivises a focus on environmental care and sustainability for many populations. Moreover, Africa’s oil and gas industry faces

growing pressures as international investment in hydrocarbons diminishes.

While Africa’s transition towards alternative energy sources presents great opportunities for the continent, this transition must be carefully managed to minimise the shortterm adverse impacts of the transition while maximising its longer-term benefits. The new bank’s responsibilities would include the management and encouragement of such a productive transition. APPO member states will be signatories to the Energy Transition Bank’s constitutional documents which will be structured in the form of a multilateral treaty, and invest equity into the new vehicle, whilst Afreximbank will coinvest and advise on the establishment and implementation process.

“We are delighted to be collaborating with APPO towards the establishment of the proposed African Energy Transition Bank. These are challenging times when we must strive to strike the right balance between the imperatives of mitigating climate change and the urgency of averting social upheavals as a result of increasingly difficult economic and financial conditions in Africa. For us at Afreximbank, supporting the emergence of the African Energy Transition Bank will enable a more efficient and

predictable capital allocation between fossil fuels and renewables. It will also free human and other resources at Afreximbank that will make it possible to support its member countries more effectively in the transition to cleaner fuels. We thank the members and leadership of APPO for their confidence in Afreximbank to support them as they embark on this very important initiative,” said Benedict Oramah, president of Afreximbank.

Omar Farouk Ibrahim, APPO secretary general, commented, “For too long we have looked outside for solutions to our challenges – access to finance, access to technology, access to markets – and so on. We have come to believe that without foreign support we cannot make any progress in addressing these challenges on the African continent.

“But the resolve to establish

the Africa Energy Bank, evidenced in the signing of an MoU between these two African institutions – Afreximbank and APPO – is a clear indication of the changing orientation of Africans to how to address their challenges. How else do Africans expect to harvest the 125 bn barrels of crude and over 500 trillion standard cu/ft of gas when the traditional financiers have decided to abandon the continent? How else do we manage the impact of climate change on the continent without the resources to make the investment? How else can we give access to energy to 600 mn people on our continent who have no access today? Africa is fully supportive of the fight against climate change because we bear the biggest brunt and we contribute the least carbon emissions, but we must engage in the fight in a collaborative and just manner.”

Now, even the World Bank has changed its stance on financing natural gas initiatives post the demand crisis that rose from the eastern European conflict. It has said that in exceptional circumstances, “consideration will be given to financing upstream gas in the poorest countries where there is a clear benefit in terms of energy access for the poor and the project fits within the countries’ Paris Agreement commitments.”

PROJECT FINANCE ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 25

African Energy Transition Bank’s responsibilities include the management and encouragement of a productive transition.”

The World Bank has considered financing upstream gas in countries where there is benefit in terms of energy access.

Image Credit: Adobe Stock

DISCOVERING AFRICA’S DIGITAL ENERGY TRANSFORMATION

IN THE DYNAMIC realm of the oil and gas industry, Africa has become a focal point of intrigue as it embraces the digital era. In a world where technology has assumed an undeniable role in shaping the trajectory of enterprises, the once-conventional extractive sector now stands at the edge of transformation.

Amidst the swift progress of technology, the Nigerian oil and gas sector finds itself compelled to wholeheartedly embrace digitalisation. The push behind this shift lies in the sector's keen pursuit of overcoming operational challenges, fortifying decision-making frameworks, and fostering sustainable growth over the long haul.

Enter the steadfast alliance between SNL Technology Services and enterprise software solutions purveyor, IFS. This collaboration is engineered to optimise operational efficiency, expeditiously streamline production processes, and notably elevate productivity levels within the sector.

According to the CEO of SNL Technology Services, Ladi Soyombo, the primary aspiration of this collaboration resides in crafting bespoke solutions tailored to the distinct demands and that define the Nigerian oil and gas landscape. In doing so, they manifest an unwavering commitment to catering to the sector's exclusive requirements and propelling it towards

unprecedented heights of accomplishment.

“By harnessing the power of technology, we aim to unlock new opportunities, improve operational efficiency, and drive sustainable growth within the industry. By integrating advanced

technologies, the partners aim to create a more interconnected, intelligent, and efficient industry ecosystem,” remarked Soyombo.

He went on to explain that these changes come at a critical time for Nigeria, coinciding with the Government’s push to digitalise various sectors across the nation.

Following the strides in digitalisation, 4Subsea, a leading technology and services provider, introduced Marine Operations DynOps, a digital solution for optimising weather-dependent marine vessel operations. Utilising the 4Insight data

sharing platform, DynOps empowers ship operators with advanced analytics, combining vessel sensors, motion data, and weather forecasts to predict vessel reactions accurately. A major shipping operator on the Norwegian Continental Shelf has already embraced DynOps to overcome harsh environmental challenges, opening the door for other regions across Africa to do the same in due course.

By combining live vessel response data and weather forecasts, DynOps achieves up to 30% reduction in waiting on weather for marine operations,

Africa has become a focal point of intrigue as it embraces the digital era.”

Standing at the cusp of a digital revolution, Africa’s oil & gas industry is set to embrace a major transformation, writes Minhaj Zia.

DIGITALISATION ISSUE 4 2023 • WWW.OI LREVIEWAFRICA.COM 26

Africa’s oil & gas industry stands ready for a digital revolution.

Image Credit: Adobe Stock