XERO LAUNCHES THE FIRST-EVER XERO AWARDS IN CANADA

Annual program to recognize the outstanding achievements of Canadian accountants, bookkeepers and app partners

XERO, THE GLOBAL SMALL BUSINESS PLATFORM, IS PLEASED TO ANNOUNCE THE LAUNCH OF THE FIRST-EVER XERO AWARDS IN CANADA. THE ANNUAL PROGRAM CELEBRATES XERO’S VALUED COMMUNITY BY PUTTING ACCOUNTANTS, BOOKKEEPERS, AND APP PARTNERS IN THE SPOTLIGHT, AND RECOGNIZING THEIR COMMITMENT TO EXCELLENCE AND ONGOING SUPPORT OF THE SMALL BUSINESS SECTOR.

In its inaugural year, Xero invites its community of accountants, bookkeepers and app partners to submit nominations for the following eight categories in recognition of efforts between April 1, 2022 and March 31, 2023:

• Accounting Partner of the Year

• Bookkeeping Partner of the Year

• Enterprise/National Partner of the Year

• Cloud Champion of the Year

• Innovative Partner of the

Year

• Community Partner of the Year

• Practice App Partner of the Year

• Emerging App Partner of the Year

The finalists in each category will be reviewed by a panel of 16 judges, inclusive of a cohort of tech and accounting industry leaders. Among this year’s judging panel are Rick Johal, CEO of CPB Canada, Leonie Phillips, Partner and co-founder of Action Exchange, Steve

Reaching for the Stars

Jirav Secures $20M in Series B Funding. What's in it for You?

IT’S AN EXCITING DAY AT JIRAV. TODAY WE’RE OFFICIALLY ANNOUNCING THAT WE HAVE RAISED $20 MILLION IN OUR SERIES B FUNDING ROUND LED BY COTA CAPITAL AND POWERED BY MANY OF OUR ONGOING INVESTORS.

Jirav has experienced record growth over the past few quarters, with hundreds

Saturday 15th July 2023

of new companies joining our platform every month.

This positive momentum affirms the value and trust our customers place in us. Thank you!

This new round of funding will enable us to continue revolutionizing financial planning and analysis (FP&A) for accounting and finance teams around the world, building resilience in challenging economic con-

ditions. To propel our customers and Jirav forward, we will focus on fueling product development, expanding our customer base, and attracting exceptional talent to join our team.

Fueling Growth and Product Development

Our goal has always...

Keep reading

Janz, Accounting Instructor at the Southern Alberta Institute of Technology, and Michael Kravshik, Co-founder and CEO at LumiQ.

Judges will look to identify the accountants, bookkeepers, and app partners who have gone above and beyond to offer their clients the best value possible through:

• exemplary service;

• a broader commitment to the communities they operate within; and

• demonstrated innovation

that aims to improve the lives or livelihoods of other accounting and bookkeeping partners, or their own small business clients.

“The Xero Awards celebrate achievements and excellence across the Xero partner and app ecosystems. It’s a wonderful opportunity to thank our trusted partners for the amazing support they provide to their small business customers and the value they add to improving the accounting industry in Canada,” said

Faye Pang, Country Manager, Xero Canada. “It’s a pleasure to see our partners succeed and we couldn’t be prouder of the contributions they make to our small business community.”

Nominations are open now until August 24, 2023. To learn more and apply, please visit xero.com/ca/awards23 before the deadline. The finalists will be announced on September 27, 2023 with deliberation leading to winner announcements on...

Keep reading

Revolut launches in New Zealand

REVOLUT, THE GLOBAL FINANCIAL SUPER APP WITH MORE THAN 30 MILLION CUSTOMERS WORLDWIDE, HAS LAUNCHED ITS SERVICES IN NEW ZEALAND TODAY, DELIVERING KIWIS A FIRST OF ITS KIND DIGITAL MONEY EXPERIENCE.

For the first time ever, New Zealand residents will get access to Revolut’s seamless, safe and secure money app that enables them to affordably hold, send and spend in multiple currencies locally and when travelling, as well as save, track and manage all of their finances in one digital location.

More than 26,000 Kiwis have already registered their interest in joining the Revolut platform by signing up to the waitlist over a 12-month test period. Revolut’s launch marks a momentous milestone for financial services technology in New Zealand.

Disrupting the financial sector

According to a recent survey by Consumer NZ*, almost 40% of Kiwi consumers don’t trust their banks which is unsurprising considering that collectively the sector recorded profits after tax of $1.5 billion since the March 2023 quarter yet

have continued to under index when it comes to their digital offerings. The continually high bank profits is demonstrative of the lack of competition available to consumers in New Zealand, and so by penetrating the financial services market in the country, Revolut hopes to both increase consumer choice and drive market competition.

Making FX affordable

On average, major banks charge* between 3% and 4% on individual remittance transactions. In 2022...

Find out

Biweekly Saturday 15th July 2023 | No. 59

The independent user news source for accounting apps and their ecosystems

XU XU

cards for EVERYONE Get yours now

more FREE digital business

New Apps & Updates

RAVE BUILD BLOG: STAY UP TO DATE WITH SOFTWARE RELEASES AND THE HAPPENINGS AT RAVE HQ

This new report displays the total of your quotes in all accepted estimates (including variations) by category, compared to the invoices sent for those categories. This allows you to ensure you have properly charged your clients and haven’t left any money on the table.

A step-by-step FAQ guide will be available from RAVE Help soon.

Many-to-One Invoicing from the Progress Payments sub-tab – RAVE Financial Update

This feature allows you to

XU BIWEEKLY - No. 59

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell Director of Strategic

Partnerships: Alex Newson

Design & Communications

Manager: Bethany Fulks

Creative Assistants: Hebe Vermeulen, Robyn Consterdine

Advertising: advertising@xumagazine.com www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2023. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

select multiple invoiceables from the progress payment sub-tab, choose specific percentages to charge for each invoiceable, and then create a single invoice (or credit note) for them all.

A step-by-step FAQ guide will be available from RAVE Help soon.

Convert an Estimate to a Payment Schedule

– RAVE Financial New Feature

This feature allows you to take an accepted estimate (from your RAVE FMS workflows) and turn it into a payment schedule invoiceable.

You can then choose to add those as a list of invoiceables, or just convert

Coming soon to Float: New Role management for streamlined project estimation

the estimate into a single line invoiceable using the category name(s) as the description and the category total(s) as the amount.

A step-by-step FAQ guide will be available from RAVE Help soon.

Bulk Payment of Invoices & Credit Notes –RAVE Financial Update

You can now select multiple invoices & credit notes, and add payments to all of them at once. This is much faster than the previous process, which required payments to be added to an invoice individually.

A step-by-step FAQ... Find out more

Add

AS BUSINESSES GROW AND EXPAND, MANAGING ACCOUNTS RECEIVABLES CAN BECOME A DAUNTING TASK. WITH COUNTLESS INVOICES TO SEND OUT AND PAYMENTS TO TRACK, IT’S NO WONDER THAT MANY BUSINESSES STRUGGLE TO KEEP UP WITH THEIR ACCOUNTS RECEIVABLES. THAT’S WHERE OUR NEW AI-POWERED EMAIL INTEGRATION COMES IN.

Soon in ezyCollect: AI-powered email generator

We’re excited to announce that we’re launching a new feature that will revolutionise the way businesses manage their accounts receivables. Our AI-powered email template generator takes

the hassle out of sending out email reminders, with each email customised based on the recipient and the keywords you provide.

This new feature makes it much more likely that your customers will respond and pay up, since each email is tailored to the specific customer. A bespoke approach that also works at scale, and is fully automated – so you never have to struggle through writer’s block again. Say goodbye to generic payment reminders and hello to personalised, effective email communication.

How does the AIpowered email generator work?

Our AI-powered email integration is easy to use and...

Find out more

WE'RE

EXPANDING HOW YOU CAN MANAGE ROLES IN FLOAT TO SUPERCHARGE

YOUR PROJECT PLANNING.

In March, we renamed the 'Job Title' field to 'Role' to encourage standardized team setups. Very soon, we'll be introducing a dedicated Roles management section within your Team Settings. From here, Admins and Account Owners can easily add, edit, delete, and merge roles for their team. This streamlines the governance of how your team uses Float by making it easier to manage your team's setup and workflows. Even better, setting up roles will enable you to take full advantage of upcoming project estimation and planning features later this year.

You can start thinking about how you'll set up your roles in Float today! As the best approach, we recommend that you consider the type of work that you usually plan in Float.

What roles does your team usually look for when planning project...

Keep reading

RELEASED ON 18 MAY 2023, THE SIMPLE FUND 360 TAX TIME UPDATE SUPPORTS THE 2023 SMSF ANNUAL TAX RETURN, COMPLETE WITH ALL THE REQUIRED SUPPORTING SCHEDULES AND ELECTRONIC LODGMENT TO THE ATO FROM 1 JULY 2023.

SBR electronic lodgment has also been switched on following ATO system updates. Support for newly registered funds and funds winding up for the 2023 Annual Return is also supported.

“I am continually impressed with our Simple Fund 360 team," said Ron Lesh, BGL's Managing Director. “Since 1 January 2023, they have delivered 6 significant updates, including support for the 2023 SMSF Annual Return 6 weeks before the end of the financial year and even SBR electronic lodgment before 30 June 2023.”

Keep reading

MyDocSafe June 2023 release notes

WELCOME TO OUR JUNE 2023 RELEASE NOTE. HERE IS WHAT IS NEW:

Workflows dashboard

We added search and sorting for easier data lookup. Note that ‘Home’ dashboard shows all workflows started across all portal groups and portals. If you are interested in looking at worklfows started in a specific Portal Group, you can ither sort the ‘Home’ dashboard by Portal Group (the right most column below) or go to the relevant Portal Group where a pre-filtered dashboard is also available.

ID verification in portals

You can now define your own instruction which the client will see before starting the process. The instruction will appear in the client’s portal, in the tab hosting the ID verification steps. This new utility, although simple, must not be understated. It is often better to over-communicate rather than leave the client interface without written clues. Over-verbosity has an advantage of minimising client inquiries, saving you time and empowering the client to complete the tasks without handholding.

Dropbox and Google Drive connectivity

We have moved the connector from Personal Settings to Company settings to reflect our new implementation of the connector. From now on, only one connection per...

Keep reading

NEW XERO CONNECTED APPS!

ALLIO

AU - Your one-stop-shop for trade and professional service businesses to manage their quotes, jobs, time and cost tracking and invoicing. Built to help run your daily operations with ease and efficiency, and improve your bottom line.

CONTENT SNARE

GLOBAL - Tired of chasing clients for info?

Then it's time to check out the simple way to onboard clients, collect documents and get answers, without endless back and forth. Similar to a client portal, Content Snare is like a checklist for your clients with automatic reminders.

NETTVERK

AU, NZ & UK - Managing data across multiple systems can be a challenge. Nettverk seamlessly integrates Salesforce and Xero, synchronizing all your business information effortlessly. Srive sales, improve customer relationships and streamline your business.

XU Biweekly | No. 59 2 Saturday 15th July 2023

NEW CHARGE UP REPORT – RAVE FINANCIAL NEW FEATURE

AI to your AR: A sneak peek at the AI-Powered Email Generator by ezyCollect

Xero announces inaugural Xero Beautiful Business Fund to boost future aspirations of small business

Over $750,000 NZD in funding up for grabs for small businesses globally

COINCIDING WITH XERO DAY 2023THE DAY OF XERO’S FOUNDING 17 YEARS AGOXERO, THE GLOBAL SMALL BUSINESS PLATFORM, TODAY ANNOUNCED A NEW GLOBAL SMALL BUSINESS FUND WITH MORE THAN NZ$750,000 IN FUNDING, TO SUPPORT THE FUTURE ASPIRATIONS OF SMALL BUSINESSES GLOBALLY.

The Xero Beautiful Business Fund will officially launch with a call for entries at Xerocon Sydney, taking place in Sydney on 23-24 August 2023.

Designed to celebrate small businesses, empower success and accelerate their growth, the Xero Beautiful Business Fund will be open to Xero small business customers in Australia, New Zealand, Singapore, South Africa, the United States, Canada and the United Kingdom.

Customers in each country will be eligible to apply

SPOTTED ON SOCIAL

for the following funding categories that best suit their needs.

• Innovating for sustainability: For small businesses who want to take the next step on their sustainability journey. It could be to move to sustainable packaging, implement energy-efficient equipment or carbon neutral transport.

• Trailblazing with technology: For small businesses seeking to take the next step to supercharge their business by digitalising parts of their operations or integrating new emerging technologies.

• Strengthening community connection: For small businesses or non-profits striving towards community connection. It could be to contribute to philanthropy, social good, or make an impact on the community in a meaningful way.

Keep reading

CreditorWatch partners with Credit Sense to expand end-toend commercial credit risk management offering

BUSINESSES IN

THE UK CAN NOW

GIVE THEIR TRADE CUSTOMERS UP TO 12 MONTHS TO PAY FOR PRODUCTS OR SERVICES, WITH A NEW FEATURE OF IWOCA'S INTEGRATED B2B PAYMENTS SOLUTION IWOCAPAY.

Building on a 3 month offering, iwocaPay has now added a second option allowing businesses to pay over 12 months.

iwocaPay’s ‘Pay in 12’ solution provides a new way to improve the cash flow tension between buyers and suppliers. Be-

ing able to offer 12 month payment term means suppliers get paid up front, and can re-invest funds back into the business immediately – while still giving eligible trade customers the option to spread their purchases even further. For trade customers, a ‘Pay in 12’ option can mean a 70% lower monthly payment and more time to realise the returns of a purchase.1

The new feature allows businesses to manage their payments like a SaaS subscription model; they... Read more

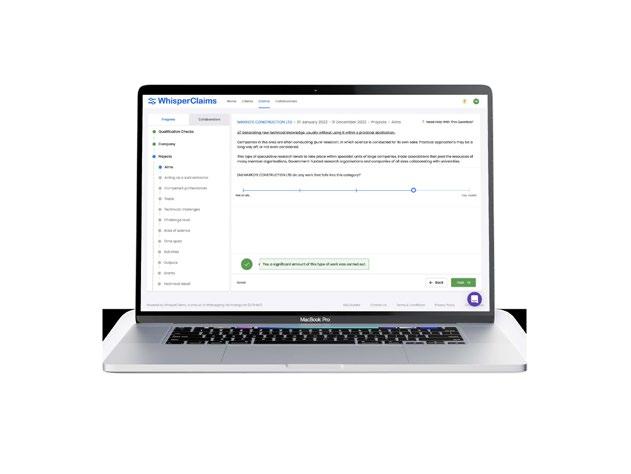

WhisperClaims Extends Support Offering for HMRC’s Additional Information Form

WHISPERCLAIMS, AN AWARD-WINNING UK-BASED R&D TAX FINTECH COMPANY, HAS TODAY ANNOUNCED ITS LATEST SUPPORT OFFERING TO ENABLE ACCOUNTANTS TO SUBMIT EFFECTIVE CLAIMS COMPLIANT WITH HMRC'S NEW ADDITIONAL INFORMATION FORM (AIF), WHICH COMES INTO EFFECT 1 AUGUST 2023.

Initially proposed to apply to claim periods starting on

or after 1st April 2023, following the Spring Budget, the new requirement affects all claims submitted on or after 1st August 2023, placing additional demands for information on claimants and accountants.

The change of effective date means that all claims submitted after 1st August will need to be submitted with an AIF, regardless of claim dates or when the claim was prepared.

Find out more

CREDITORWATCH HELPS BUSINESS LENDERS PROVIDE FASTER LOAN APPROVALS BY COMPLETING LOAN AFFORDABILITY ASSESSMENT IN JUST MINUTES, INSTEAD OF HOURS

CreditorWatch, a leading commercial credit reporting bureau, today announced its partnership with bank transaction data analytics and affordability insights provider, Credit Sense to help business lenders determine whether a borrower can afford to repay a loan within minutes

Lenders are under pressure to provide loan approvals quickly in order to onboard good customers and grow their business. Meanwhile, they remain obligated to conduct numerous

due diligence checks such as loan affordability assessments that can take hours (or even days) to complete manually.

“By partnering with Credit Sense, we expand our endto-end credit risk management capabilities to help our lending customers conduct necessary due diligence tasks quickly, in a cost-efficient and user friendly way” said Patrick Coghlan, Chief Executive Officer at CreditorWatch. “We know our lending customers are under pressure to meet customer expectations or they risk losing out to competitors who have a smoother application experience and the ability approve their application faster.”

Being a market leader in...

Find out more

XU Biweekly | No. 59 4 Saturday 15th July 2023

News & Updates

One million businesses can now get 12 month payment terms

Wolters Kluwer appoints Vikram Savkar as General Manager for Compliance Solutions

SAVKAR BRINGS A WEALTH OF EXPERIENCE, INSIGHTS, AND TECHNOLOGY EXPERTISE TO EXECUTIVE LEADERSHIP POSITION

Wolters Kluwer Compliance Solutions, a market leader and trusted provider of risk management and regulatory compliance solutions and services to U.S. banks, credit unions, insurers and securities firms, has named Vikram Savkar as its new Executive Vice President and General Manager. He is based in Wolters Kluwer’s Waltham, Mass. office and has a global remit to oversee the growth of the award-winning business.

In this role, Savkar oversees a successful, growing business within Wolters Kluwer noted for its product innovation, technology advancements, and unparalleled domain expertise. Wolters Kluwer Compliance Solutions has experienced strong organic growth in recent years, also acquiring leading businesses in the digital lending arena. The business is dedicated to helping financial institutions efficiently manage risk and regulatory compliance obligations while gaining the insights needed to focus on better serving their customers and growing their business.

“I am thrilled that a capable, experienced leader with Vikram’s strong skillset has taken the helm for our talented and growing Compliance Solutions team and am excited at the positive impact he will bring to the business and to our customers,” said Steve Meirink, CEO of Wolters Kluwer’s Financial & Corporate Compliance (FCC) division, in referencing Savkar’s appointment as demonstrative of an enterprise-wide commitment to developing and promoting talent from within Wolters Kluwer.

With this development, Savkar also becomes a member of the FCC Executive Leadership Team. “Vikram will leverage his diverse experience across Wolters Kluwer to drive transformational initiatives that support our pursuit of accelerated growth—and our longstanding commitment to the delivery of impactful solutions to help the many professionals we serve,” Meirink added.

Savkar joined Wolters Kluwer in 2012 as Vice President and General Manager of the company’s Legal & Regulatory division, helping accelerate the growth of its international legal business. In 2019 he joined Wolters Kluwer’s Health division as Senior Vice President and General Manager, where he was most recently responsible for the Medicine Segment of the Health Learning, Research & Practice business. During this time Savkar oversaw product innovations that...

Keep reading

Xero announces changes to Board of Directors

XERO LIMITED (ASX: XRO) TODAY ANNOUNCES THE APPOINTMENT OF ANJALI JOSHI AS AN INDEPENDENT NON-EXECUTIVE DIRECTOR TO ITS BOARD, EFFECTIVE 3 JULY, AND THE RETIREMENT FROM THE BOARD OF NON-EXECUTIVE DIRECTORS ROD DRURY AND LEE HATTON, EFFECTIVE AT THE CLOSE OF XERO'S ANNUAL MEETING ON 17 AUGUST 2023.

Based in San Francisco, California, Anjali is an experienced technology and product leader and professional director with more than 30 years’ experience in engineering and product management. Anjali will stand for election by shareholders at Xero's Annual Meeting.

Xero Chair, David Thodey said: "We're excited to welcome Anjali to the Xero

Board. Anjali's global expertise in product and technology, and her extensive experience as a professional director, make her a valuable asset to Xero and our Board."

Commenting on her appointment, Anjali Joshi said: "I'm thrilled to be joining Xero's Board and am excited to bring my deep technology experience to help Xero deliver on its significant potential. I've worked for many large and scaling global companies and I’m passionate about how technology can be used to drive better business outcomes."

Rod Drury has decided to step down from Xero's Board after serving as an executive director for 12years, and a non-executive director for five years. He will remain as an advisor to the business, supporting the Board and CEO. Having founded

BGL appoints Executive Team to drive strategic growth and innovation

WELCOME TO OUR ANNUAL AUSTRALIAN FINANCIAL YEAR TRADING SNAPSHOT FOR SMSFS, WHERE WE LOOK AT SHARESIGHT USERS’ 20 MOST TRADED SMSF STOCKS DURING THE 2022/23 FINANCIAL YEAR. TO FIND OUT THE MARKET-MOVING NEWS BEHIND SOME OF THESE STOCKS, KEEP READING.

BGL Corporate Solutions (BGL), Australia's leading provider of company compliance, self-managed superannuation fund (SMSF) and investment management software, is proud to announce the appointment of an Executive Team of exceptional talent to drive strategic growth and innovation.

"I'm so proud of each member of the BGL Executive Team," said Ron Lesh, BGL's Managing Director. "Comprised of seven individuals with a combined total of 123 years of service at BGL, these leaders bring extensive experience and unwavering dedication to driving BGL's strategic growth and innovation. Our products, clients and team could not be in better hands."

The purpose of the BGL Executive Team is to deliver on the strategic and operational requirements of BGL. With a strong emphasis on growth and development, their goal is to retain, educate and grow our people, clients, partners and the industries in which we work. By maintaining core values and a commitment to exceptional products and experiences, the team aims to achieve sustained growth across all facets of the business.

Introducing the members of the BGL Executive Team:

• Ashley Avileli - Chief Technology Officer Admired and respected for his can-do approach and profound IT knowledge, Ashley and his team keep our BGL cloud software running every day of the year.

Find out more

Xero in 2006, for more than a decade as CEO, Rod led Xero to become a global business. He has been integral to Xero's success, culture and strategy throughout his tenure as its founder, CEO and director.

David Thodey said: “Over the past 17 years Rod founded and built a global company - with a clear vision and purpose - that digitally disrupted an industry. Rod has been a vital member of ourBoard, and I want to acknowledge his visionary leadership to drive the substantial growth of the business. He helped the Board to complete two CEO transitions, his own to Steve Vamos in 2018, and more recently Sukhinder Singh Cassidy’s appointment in 2022. We are grateful for Rod’s enormous...

Find out more

The Accountants’ Game-Changing Guide to Preparing R&D Claims In-House

IN THE LAST 12 MONTHS, HMRC HAVE MADE CHANGES TO THE R&D TAX RELIEF SCHEME IN A BID TO ERADICATE THE MALPRACTICE THAT HAS DEVELOPED WITHIN THE R&D TAX SECTOR.

While this extra scrutiny is welcome in a market that has, without any doubt, experienced problems due to a few bad apples, this shift in HMRC’s behaviour has caused some ripples to be felt across the R&D tax advisory sector. Some accountants are rightly seeing this as an opportunity to improve their operations, move their clients away from third party providers and implement a new R&D tax service offering under their own brand. They are realising that their clients are hungry for support, and there is a way to add more value to these client relationships.

DEXT IS INCREDIBLY PLEASED TO ANNOUNCE THE APPOINTMENT OF EMILY WESTGATE AS OUR NEW CHIEF MARKETING OFFICER.

Emily joins us from Signal AI, the external intelligence company, where she was key to driving the company’s messaging and growth.

With over 20 years of experience, Emily is an experienced marketing leader in high growth and corporate environments within the technology industry. At Signal AI, she joined as VP of marketing in 2019 and was named as CMO in April 2022. Her background within technology companies spans across her experience with marketing roles at Toshiba, Oracle, and adtech company, Criteo.

Emily’s hiring marks another step in Dext’s continued growth. As leaders in pre-accounting software, Dext is enabling accountants, bookkeepers and businesses to utilise trustworthy data for their everyday accounting tasks, saving them vital time when it really counts.

Our CEO, Sabby Gill, had this to say: “As Dext continues to grow across the accounting and SME space, a robust marketing strategy is essential. Machine learning, AI and emerging technologies are a core part of our product strategy, so it’s a pivotal time for Emily to be joining us. We welcome Emily’s expertise in transformative marketing strategies, especially as we enter our next phase of...

Read more

A good accountant who understands the claimant’s business and who can steer them effectively through the eligibility criteria is precisely the kind of advisor who should be preparing claims in the eyes of HMRC. A deep, existing relationship is the very best way for an advisor to identify legitimate R&D work, which in turn helps remove the risk of SMEs being exposed to bad practice.So, what are the essential tools that accountants will need to deliver a dependable R&D tax service in-house, and what role can R&D tax technology play? Mike Dean, Managing Director at WhisperClaims explores further…

The smart in-house service

It is absolutely possible for businesses to bring R&D tax relief services in-house without compromising on quality. Adopting the right technology, expert-led support, and training, accountants can provide a level of service that exceeds clients’ expectations and ensure that you meet all of HMRC’s requirements.There are some key elements to success. First, ensuring clients have at least a passing understanding of the relevant parts of the guidance is crucial. In the end they’re the ones who have the detailed knowledge of their projects, and are best placed to assess whether they are eligible. Accountants need to ask the right questions so that they understand what HMRC's definition of R&D looks like and can assess if the eligibility criteria have been met.

Using appropriate software, questions flex around the data being input—none can be missed or skipped, ensuring all data is...

Find out more

News & Updates XU Biweekly | No. 59 6 Saturday 15th July 2023

The home of XU Magazine and XU Biweekly XU Hub is now on Apple News!

Emily Westgate joins the Dext senior team to spearhead growth and marketing strategies.

Joiin scoops two FinTech South West Awards

FINTECH INNOVATOR, JOIIN, SCOOPED TWO AWARDS AT THE INAUGURAL FINTECH AWARDS SOUTH WEST ON THURSDAY 6 JULY 2023, FOR BEST GROWTH STORY OF THE YEAR (SPONSORED BY DELOITTE) AND FINTECH EXPORTER OF THE YEAR (SPONSORED BY W LEGAL).

About the FinTech South West Awards

The FinTech Awards South West recognise the achievements of the thriving FinTech sector across England’s South West, celebrating the fantastic companies making

a difference and bringing innovators and digital experts together for an exciting awards evening.

Joiin scooped two awards: Best Growth Story of the Year (sponsored by Deloitte) and Fintech Exporter of the Year (sponsored by W Legal).

Joiin’s story

Based in Exeter, Devon, in the South West of England, Joiin is a fast-growing software-as-a-service (SaaS) company delivering a globally-available cloud-based consolidated financial reporting platform.

Having launched its first

minimum viable product (MVP) in 2019, Joiin started achieving its first revenues in Q1 2020. Since then, the company has snowballed, with recurring subscription payments increasing dramatically due to the rapid scaling of its business and expansion into crucial new markets.

Along the way, the company has firmly established its platform in the FinTech space as a trusted brand, now boasting over 30,000 plugged-in companies across 103 countries globally. Just 31% of its customers are in the UK, with exports...

Keep reading

WATCH A FREE WEBINAR ON THE XU HUB

APAC WEBINARS UPCOMING EVENTS

THE WORLD’S MOST INNOVATIVE CLOUDBASED WORKING PAPERS SOLUTION, MYWORKPAPERS, HAS BEEN DECLARED THE WINNER AT THIS YEAR’S INTERNATIONAL ACCOUNTING AND FORUM AWARDS (IAFA).

Used by thousands of accountants around the world, MyWorkpapers has been reaching new markets and innovating to offer essential software to the industry.

Judges at this year’s IAFA were impressed with the firm’s growth and its focus on developing solutions that helped the profession to work more efficiently and effectively than ever before.

The awards also recog-

nised the firm’s significant growth within the market during a record year for MyWorkpapers and its commitment to training, implementation and education.

This is the 12th Annual IAFA and the second time that MyWorkpapers has made the shortlist. This popular international event brings together accounting firms along with regulators and industry bodies, consultancies and advisors to discuss the key themes impacting the sector and the opportunities for growth.

Many of those who attended got to experience the MyWorkpapers’ platform first-hand during the day-long conference, before sharing in the celebrations in

the evening.

Rich Neal, MyWorkpapers’ CEO, said: “Winning at the IAFA is a real accomplishment and a demonstration of our commitment to supporting the development of the accounting industry.

“The last few years have seen us undertake a period of rapid change and development, which has made us essential to the operation of many practices.

“We are truly privileged to receive this award, but this wouldn’t be possible without our incredible team, integration partners and, of course, the support of our growing number of users worldwide.”

Find out more

Events & Webinars XU Biweekly | No. 59 8 Saturday 15th July 2023

UPCOMING

The Cloud

Podcast is now... The Accounting Podcast! FIND OUT MORE MyWorkpapers declared Accountancy

The Year at top awards

Accounting

Software of

Accountant Tools Time for Business Find out more at Dext.com Award-winning cloud software and knowledge solutions for your accounting practice. CCH iFirm CCH iKnow CCH Learning → Bills & Expenses The smarter way to handle bookkeeping. Start your free trial today! Cloud Integrators CRM eCommerce Powerful Software Delightfully Simple Integrates seamlessly with TidyStock and TidyEnterprise to provide a unified solution to your operations. POWERFUL ECOMMERCE 10 - 11 October 2023 Suntec Convent on Cen re S ngapore REGISTER FREE Inventory tidy nternational com STOCK MANAGEMENT Powerful Software Delightfully Simple Powerful software enables your business to grow through endto-end process control and reporting. Invoicing & Jobs Take control of your last mile deliveries www.vworkapp.com tidyinternational com Powerful Software Delightfully Simple Need brick-by-brick control of your building & construction projects? TidyBuild is designed specifically for the construction industry. CONSTRUCTION MANAGEMENT It’s a match made in heaven. Start your FREE trial: workflowmax.com/xero Manufacturing t dyinternat ona com Powerful Software Delightfully Simple PROJECT & INVENTORY MANAGEMENT Combines the most powerful aspects of both TidyStock and TidyWork. Outsourcing Payroll & HR New Zealand Australia ipayroll.co.nz cloudpayroll.com.au New Zealand Australia ipayroll.co.nz cloudpayroll.com.au Practice Management Professional Services Get Ready Prepare for the future at the Inspire Tour a seven-city hybrid event for bookkeepers www bookkeepers o g uk/even s Reporting castawayforecasting.com/xu UNLOCK YOUR POSSIBILITIES Deliver an R&D tax service that your clients can trust. whisperclaims.co.uk Time Tracking tidyinternational com JOB MANAGEMENT Powerful Software Delightfully Simple Detailed reporting and tight project controls enable your business to maximise efficiency and profitability. Year End Classifieds XU Biweekly | No. 59 Saturday 15th July 2023 9 Issue 35 1 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine magazine The independent news source for users of accounting apps & their ecosystems ISSUE 35 The next wave of global growth for ApprovalMax What can their evolution teach us about innovation? Xero PLUS MORELOADS FROM Connected Apps TUTORIALS CASE STUDIES INTERVIEWS NEW APPS NEW RELEASES 9 772054 722009 COVER STORY ISSUE 35 OUT NOW XU Subscribe to our mailing list and never miss an issue! Hub Subscribe 9 Daily The latest news from all your favourite Xero connected apps 9 Every fortnight XU Biweekly 9 Quarterly XU Magazine

By Kylie Wing, Chief Marketing Officer, ApprovalMax

JOIN KYLIE WING, CHIEF MARKETING OFFICER AT APPROVALMAX, AS SHE TALKS TO THE NEWEST ADDITION TO THE TEAM: MATT LOWRY, CHIEF REVENUE OFFICER.

Matt leads the global sales and customer success teams. His role is pivotal to ensure ApprovalMax continues to grow in the Xero ecosystem and the company’s global customer base continues to get value from the product.

Kylie: Welcome to the team, Matt – we’re so pleased that you’ve joined ApprovalMax at such an exciting time of growth! We currently have just over 100 team members who are spread across 30 different countries. What inspired you to join ApprovalMax?

Matt: I’m really excited to be joining the team! The growth to-date speaks for itself, picking up several Xero awards and being shortlisted for others recently in several geographies is a testament to the great work the team is doing. Speaking with the Founders highlighted the

exciting new product developments that are planned to continue this growth trajectory and I like that we are expanding into new markets with a goal of being an endto-end AP solution of choice.

Having come from another company within the Xero ecosystem, I was already familiar with ApprovalMax’s great reputation and bestin-class product. I’m glad I get to keep working in the cloud accounting industry because it’s great to be part of a mission where we help accountants, bookkeepers, and SMEs worldwide have a tangible impact on society.

Kylie: We definitely have a ripple effect when it comes to our impact and the communities we serve, so you’ve joined the right team. Tell me about your background and what I’d find out about you if I was to look on your LinkedIn profile.

Matt: I originally have a legal background, working inhouse for a small-cap listed technology company in the UK. I transferred internally to head up their customer experience department after realising that I enjoy being in the driver's seat and making

decisions, rather than reactively acting on decisions in a purely legal sense! This experience gave me first-hand experience of board meetings and the impact that internal red tape can have on growth. If only we had ApprovalMax and some of the other leading ecosystem apps to help!

In late 2018, I joined the management reporting and forecasting app, Fathom, to launch their UK office. The role was to grow the revenue base significantly and I became their Head of Growth (EMEA), leading goto-market activities in the EMEA region, primarily the UK and South Africa. Helping thousands of SMEs and advisors globally to change how they view forecasting and management reporting was a greatly rewarding experience and showed me first-hand the impact that great AccounTech can make to businesses globally.

Kylie: We have something in common. My previous role was also working for another company in the Xero ecosystem where management reporting and forecasting was a huge part of the value

proposition. Helping SMEs and accounting firms understand the story behind the numbers was a big part of the inspiration. Now that you’re on a new adventure with us, what opportunities are you looking forward to diving into?

Matt: ApprovalMax is at such an exciting stage of growth, with all the recent and future product launches. I’m keen to work with the sales and marketing team to reach more of our target market to promote how ApprovalMax can really help lead the way forward!

A really recent example is the ApprovalMax and Airwallex integration for UK businesses, providing an end-to-end accounts payables solution, ensuring a seamless experience for our customers in preventing fraud and implementing inhouse financial controls. It’s great that we’re using Airwallex’s financial technology inside ApprovalMax to help businesses not only with payments, but scale across borders.

Kylie: Absolutely. We’ve just given our UK accounting partners another way to add

value with this service without requiring access to their client’s bank account. It’s automating the steps from approving it, to processing it, to paying it. I think it’s fantastic that our team has created a faster and smoother workflow, and that it can be done without having to leave the ApprovalMax platform.

Matt: Outside of that, we also want to continue making our existing customers happy and provide them with world-class customer support – this is particularly important as we scale to new markets and geographies. Personally, I’m also looking forward to continuing to advance our relationship with Xero accountants and bookkeepers, and assisting them with implementing in-house financial controls and workflows to their clients. That’s important because it ultimately adds deeper value to their relationships.

I want to also add to that list the new corporate identity and brand direction that your team has been heavily involved in – what was the story behind the new branding?

Kylie: The ApprovalMax story is interesting because the roots go as far back as 2014. The brand has evolved over the years, but at the end of 2022, we decided it was time for a new look. We wanted something that was deliberate, more modern, and software relevant. We exchanged our darker colours for ones that were brighter, lighter, and more energetic. It’s happening during a phase when there are a number of exciting internal changes and new people joining our team, such as yourself, Justin Campbell from Xero, Brendan Lucas as our Head of Accounting, and Cassandra Scott as our Head of Bookkeeping, just to name a few. Can you relate to the evolution of the brand, and why branding in SaaS is important?

Matt: The new brand looks clean and concise, which for me is imperative to stand out in any market. The timing is perfect as we move into a new stage of growth with a more comprehensive product. The new brand reflects the new stage of the journey that we are now on.

Keep reading

Features XU Biweekly | No. 59 10 Saturday 15th July 2023

Q&A with Peter Lalor, Founder & Chief Executive Officer, BlueRock

Parlez-vous français?

MELBOURNE IS WELL-KNOWN FOR ITS FAMED LANEWAYS AND ARCADES, SPLASHED WITH VIBRANT GRAFFITI ART, LUSH BOTANICAL GARDENS AND A THRIVING BUSINESS DISTRICT. THE CITY IS ALSO RENOWNED FOR ITS DISTINCT BLEND OF CONTEMPORARY AND VICTORIAN ARCHITECTURE AND BUILDINGS, AND IS THE BASE FOR OVER FIVE HUNDRED THOUSAND SMBS WHO DRIVE THE SMALL BUSINESS ECONOMY.

Now, Melbourne is the new home for the team at BlueRock who have acquired Xero’s WorkflowMax brand and kicked off grand plans to take their new software to new places and spaces. With investment to boot, they are building a new product to truly scale the solution globally and offer an even richer job management capability. Leveraging the best in breed technology, with a top-notch customer service and same pricing promise - there’s lots of reasons for you to find out more…

XU: We recently caught up with BlueRock’s Founder and Chief Executive Officer, Peter Lalor for a candid interview to understand a bit more about why they love WorkflowMax so much that they want to build a similar product!

Peter is an experienced Director, CEO and Chairman with a demonstrated history of working with entrepreneurial businesses and helping SMBs run successful, profitable operations. With a huge passion for technology and thinking differently, he’s also started and scaled multiple businesses himself and plans to take the new WorkflowMax by BlueRock to the world. Fast.

Can you tell us about BlueRock?

PL: With three thriving offices based in Melbourne, Australia, we were founded in 2008 and quickly became known as a disruptive startup. BlueRock is a business for entrepreneurs, by entrepreneurs. We’re a growing team of business and technology experts who all work together to get the best outcomes for business owners. We know that business is tough, which is why we act as tech savvy advisors, and bring together lawyers, finance brokers, digital specialists, insurance brokers, financial planners, business advisory, consultants and systems and software development experts...basically everyone a business needs on their team to make life easier.

BlueRock has grown quickly to become an international business, recognised on Top 100 lists and as a ‘Best Place to Work’

company for many years. We love what we do, and we understand how to attract and retain the best talent and clients. We also place great importance on giving back to the community and, through our Be BlueRock Foundation and certification as a B Corporation, we strive to have a positive impact on the world.

We live by this mantra: Do things you love with people you care about and good things happen.

XU: Why did BlueRock acquire the WorkflowMax brand?

PL: As a tech-led advisory business, BlueRock is always looking for ways to improve the lives of SMB owners through technology and innovation. Xero’s WorkflowMax has been a solution that has ticked so many boxes for business owners including our own.

When we heard the news about Xero’s plans to retire the current product, we were eager to jump in and take over the reins and build a new product from the ground up (to be known as WorkflowMax by BlueRock). BlueRock plans to keep all the great features, functionality and pricing that customers already know and love.

Ryan Kagan, Founder of...

Keep reading

POWER UP YOUR DELIVERYINTEGRATING VWORK WITH XERO

By Steve Taylor, Chief Technology Officer, vWork

By Steve Taylor, Chief Technology Officer, vWork

relevant.

HOW

Designed as part of a connected ecosystem, vWork’s native integrations benefit those using its dispatch and scheduling software.

It is no accident vWork is designed to fill a very specific part of the transport eco-system - that last-mile delivery between your door and your customers. It forms an important part of a connected ecosystem between your Customer Relationship Management (CRM) database, any telematics tools your fleet may use and your accounting systems.

It natively integrates with a number of major brands in all these spaces - including Xero. This means customers can benefit from off-theshelf integrations with minimal time to implement and maximum value delivered - including keeping pace with any upgrades and new functionality that might be

So what does vWork’s Xero integration let you do?

Xero was a very early integration partner. According to vWork CTO, Steve Taylor, it was in high demand by customers across both Australia and New Zealand and there was real synergy in the desire to add as much mutual customer value as possible.

“Any vWork customer can simply connect their Xero instance into vWork with confidence around maintaining data security and compliance,” says Steve. “We have looked to add as much value as we can natively, with the opportunity to extend this functionality out with further configuration to meet individual customer needs if necessary.”

Faster money through the door

One of the key things vWork’s Xero integration en-

ables is the ability to instantly invoice on delivery. As a driver signs off on delivery completion in vWork, all the relevant information is immediately transferred into a Xero invoice. It takes seconds and can then be issued immediately or included in monthly billing. Either way it means billing for the delivery is immediately in Xero and more likely to be paid on time.

“It means there is no double or triple handling of data between dispatch, the driver and accounts - which is where so many errors or delays occur,” explains Steve. “The increased accuracy is a time saver in itself, as is the admin time in managing an otherwise largely paper-based system.”

vWork delivers a more efficient eco-system

This becomes even more powerful when vWork is integrated with a CRM - such as SalesForce - giving you...

Find out more

Features XU Biweekly | No. 59 Saturday 15th July 2023 11

VWORK’S NATIVE INTEGRATION MODEL CREATES AN EXCEPTIONAL LAST-MILE DELIVERY ECOSYSTEM.

Meet Robo-Advisor — a handsoff way to invest

BUILD YOUR WEALTH THE SMART WAY. INVEST EFFORTLESSLY, WITH OUR ALL-NEW ROBO-ADVISOR — GET YOUR OWN DIVERSIFIED PORTFOLIO IN MINUTES!

Moss selects GoCardless to power its push into the UK

Tandem Bank secures £20 million after successful capital raise

MOSS, THE LEADING CORPORATE CARD AND SPEND MANAGEMENT SOLUTION, HAS SELECTED GOCARDLESS, THE BANK PAYMENT COMPANY, AS ITS DIRECT DEBIT PROVIDER IN THE UK TO SUPPORT ITS INTERNATIONAL EXPANSION.

Moss automates monthend administrative tasks for SMB finance teams, freeing up their time through eliminating manual work -- including the burden of making payments. By integrating GoCardless direct debit into

the process, Moss will help customers to fully automate the management of their corporate cards, from paying expenses to repaying balances to accounting.

Working with GoCardless will also help Moss on the back end. Unlike many other corporate card providers, Moss does not charge interest on late payments. Coupled with its high credit limits -- up to £2.5 million per month -- Moss needed a reliable method to collect large amounts on a regular...

Keep reading

Hands-off investing, made for your goals

Whether saving for retirement or funding a major purchase, hit your money goals with minimal effort. Just set, forget, and don't sweat!

Investments recommended for you

Get a diversified portfolio to suit your risk appetite,

with low management fees of just 0.25% per year, with a monthly minimum fee of $0.25.*

Stay on track with automated rebalancing

For extra peace of mind, we’ll automatically rebalance your investments for you. Get a future-proof portfolio that stays true to your risk appetite — it’s like putting your money on autopilot!

How to get started

Head to Hub > Robo-ad...

Keep reading

THE INVESTMENT BY QUILAM FURTHER RE-ENFORCES THE GROWTH TRAJECTORY OF TANDEM.

Tandem, the UK’s greener digital bank, has secured £20 million in Tier 2 capital from Quilam Capital – a growth investor with expertise in the speciality finance sector.

The investment by Quilam further re-enforces the growth trajectory of Tandem as the business seeks to continue its mission of building the UK's leading purpose-led, profitable digital banking platform.

The capital raise concluded in late June 2023, following a process supported by financial services advisor Alantra.

Commenting on the transaction, Alex Mollart, Chief Executive Officer of Tandem Bank, said: “This investment marks another significant milestone for Tandem as we enter yet another exciting

stage in our journey.

“Following a transformational 2022, this capital will put extra momentum behind our green lending proposition and allows us to capitalise on a number of exciting opportunities to further grow our business.

“Crucially, we’ve found a great partner in Quliam –investors who truly understand our mission to be the UK’s greener bank and are committed to supporting our plans to get there.”

Matt Glew, Director at Quilam Capital, said: "We're delighted to be partnering with Tandem through this strategic investment. Tandem is perfectly positioned to continue to grow its market leading green lending proposition, which our capital will help to unlock.

“We’re proud to join the Tandem journey and are looking forward to an exciting future together.”

As the UK's greener...

Keep reading

Novo Introduces New Small Business Debit Card

NOVO, THE POWERFULLY SIMPLE® FINANCIAL PLATFORM FOR SMALL BUSINESSES, TODAY ANNOUNCED THAT IT IS LAUNCHING A NEW NOVO DEBIT CARD FOR ALL OF ITS SMALL BUSINESS CUSTOMERS, WHICH ENABLES A RANGE OF NEW CAPABILITIES FOR TRANSACTION MONITORING, FRAUD ALERTS, AND IN-APP CONTROLS.

“Small business owners use their debit cards to pay multiple expenses daily, and are often too busy to monitor all of their transaction activity carefully,” said Michael Rangel, CEO and co-founder of Novo. “When you consider that U.S. businesses lose as much as 5% of their gross revenue to fraud, it’s crucial for small business owners to quickly know when an unauthorized transaction is

GoCardless appoints Franck Cohen as its first Chair of the Board

Lawson.

processed. Novo’s new debit card allows our more than 200,000 small business customers to effortlessly monitor fraud, and control their card activity directly through the Novo app.” Novo’s small business debit card capabilities include:

• Real-time fraud alerts: Novo’s security monitoring continuously analyzes small businesses’ debit card purchases, quickly detecting any suspicious transactions. When there is suspected fraudulent debit card activity, Novo immediately alerts the small business owner via text message, email, and push notifications.

• Activity notifications: Small businesses can set their Novo app to receive activity push...

Keep reading

GOCARDLESS, THE BANK PAYMENT COMPANY, HAS APPOINTED FRANCK COHEN AS THE CHAIR OF ITS BOARD OF DIRECTORS TO ACCELERATE ITS PATH TO PROFITABILITY.

The industry veteran and entrepreneur brings a wealth of experience in the technology and software space, including stints as the EMEA President and Global Chief Commercial Officer during his ten-year tenure at SAP. Prior to that, he was the Executive Vice President and General Manager of North America and EMEA at

Cohen also serves as the Chairman of the Board of CYE, a cybersecurity company in Israel, and acts as an advisor to high-growth startups and tech companies including business automation platform UIPath and Workday, the leading Human Capital Management solution.

Hiroki Takeuchi, co-founder and CEO at GoCardless, said: “Franck is a very welcome addition to our growing roster of experienced leaders and advisors, all of whom will help us move to...

Keep reading

FinTech News XU Biweekly | No. 59 12 Saturday 15th July 2023

By Steve Taylor, Chief Technology Officer, vWork

By Steve Taylor, Chief Technology Officer, vWork